Today we have Nick Schmidt - trader and co-founder of both TraderLion 🦁 and Deepvue, sharing some core concepts behind a sound trading system as well as several lessons learned along the way.

Be sure to check him and both these platforms out on twitter which help traders develop a sound trading system with risk management as the main priority:

Introduction To Trading

I was sitting in an accounting class and we had a guest speaker come in and discuss short selling. He went through a few chart examples of his shorts and his thought process throughout the trades. It really opened my mind at that time because previously I’ve never heard a trader explain what they do. Long story short I was fascinated and started diving into the market head first. I have an extreme personality and it played out immediately because I became obsessed.

To make it worse, my first trade which was a total gamble I bought for $2 and sold for $14 in 1 day. You can imagine how smart you I thought I was and how much more addicted it made me.

The Beginning of TraderLion

I was always looking for groups to be a part of. I spent time going to numerous different groups meeting tons of people who all approached trading very differently. After 2 years or so of bouncing around, there was a stranger in a group who really stuck out to me. He talked about big volume spikes, institutional accumulation, and CANSLIM.

This stuck with me. The logic behind it made sense, I immediately devoured all of that content and from that point on I had a clear direction and strategy I believed in and studied relentlessly.

That stranger one day told me about a young guy my age he knows from another group that I should talk to because we were similar and that he was insanely good at making money in the market. Obviously I was interested. The guy he introduced me to was Rai.

Fast forward 6 months, Rai and I have talked every second of every day. I learned so much from him and his approach and it was noticeable in my performance as well. Everything made complete sense.

We had our own free group we made at this point which was growing super fast. This was actually the beginning of what is now TraderLion. Someone lurking in the group was former William O’Neil Portfolio Manager Ross Haber. He was silently watching us day to day and was impressed. Next thing leads to another, the 3 of us hop on the phone, I’m nervous as hell can’t believe I’m talking to Ross Haber. We have an amazing conversation that lasts for a few hours. The rest after that phone call is history. I’ve been fortunate to trade the market with those two pros every single day for the last 7 years.

My style is completely inspired and forged over the years from Rai and Ross Haber.

Routines

Daily Routine:

1. Review Watchlists & Screens:

• Up on Volume Screen (Sort by RS)

• Relative Strength Screen (Sort by price or volume)

• Fundamental Screen (Sort by RS)

Update long watchlist and alerts based on a review of results and current watchlists.

2. Industry Group Analysis:

Determine leading industry groups and character changes.

• Sort watchlists by industry group to observe trends and changes.

• If a significant amount of setups begin to appear in a particular group, instantly look through that group and related groups to be sure you've seen everything.

3. Perform Daily Stock Assessments:

Assess notable movements or trends.

• Sort watchlists by % change to evaluate the biggest winners and losers.

Get a feel for what’s up the most, what’s down the most, and most importantly if there is any action indicating that we might be at the beginning of a group rotational move.

4. Highlight Actionable Stocks:

Choose 3 - 6 high-quality stocks with immediate trading potential.

• Keep front & center when the market opens on intraday charts.

5. Set Alerts:

• Set alerts for entry and exit points. Monitor for increased trading volume.

Winning Characteristics

Whenever a potential trade comes to me, it's usually from running up on volume screen daily. So every day I'm running up on volume and generally this is where most of my stocks from on my watch list come from. So when there's unusual volume, spotted in a stock, and it has a strong setup, I'll add it to my watch list.

I trade primarily weekly charts. I do use daily charts as well. I do not use intraday charts. So all of my entry and exit decisions are based on the weekly and sometimes the daily.

Generally, to sum up what I'm looking for with potential trades is I want to see a character change.

So if the stock is trading loose and wide on the left side, not respecting its moving averages, all of the sudden it's coming up the right side, the stock is respecting moving averages and acting a lot more neat and orderly and we have institutional volume coming through. This to me shows a character change and is primarily what I'm looking for on the weekly to get involved.

Risk Management & Position Sizing

I have a very simple approach just like everything else in trading. I don't complicate anything. I'll just say that risk management is always number one. It's always the most important thing.

When it comes to position sizing generally I never have any more than six positions on at the same time and I put most of my size in three to four of them. I'll then use the rest of my capital to trade around those core positions with less liquid stocks or what we at TL like to call performance boosters. I'm really looking to concentrate most of my portfolio into the strong liquid leaders and build positions in them.

I always buy in chunks I never buy at one point. So if a stock is within a certain percent where I'm willing to buy it, I will buy chunks around that price, as long as it's within my range. This helps me scale into positions slowly and more confidently.

The Art of Progressive Exposure

Exposure for me is super simple, I can go from cash to fully invested very quickly, but it all matters and is based on the progress that I make, I will never be all cash and suddenly without reason be fully invested. It always happens systematically and it's always based on progress.

Everything about the market is about listening to it and the feedback that it gives and so when I put on a new position or two if I'm getting stopped out on my new positions, it's telling me that the market is not cooperative, and there's no reason to put more money into the market to go to work because currently, my prior positions aren't working. And so why would I get more aggressive?

Now on the other hand, if I start putting on one or two or three positions, and they're starting to make progress and the markets acting constructive and healthy, as long as I see that personal progress in my own portfolio with my positions, I will begin getting comfortable and more confident and start deploying capital much more quickly. But the most important thing and the thing that I would take away is it all matters on personal progress and the feedback that the market gives you.

If you're putting on new positions and you keep getting stopped out the market is telling you something. If you're putting on new positions and they're starting to work and make progress the market is also telling you something.

Sound Trade Management

Managing my trades depends on the market environment. The way I decide between holding positions for large moves vs taking profits into strength is basically just evaluating my recent progress, my recent trades, have they made progress, you know have breakouts in the market been working? Is it earnings season? How has that been going? Are we getting a lot of strong gaps that are holding are we getting the total opposite?

It's always going to come into context with what the market is doing. If the market has only been rewarding quick moves and really there have been no stocks that have really held their gains then I'm going to be much more aggressive and sell into strength. However, the goal is always to try to hold the position as long as possible for me.

If I see the market is super cooperative stocks are breaking out holding, advancing, rebuilding bases setting up again if we see all this healthy action that supports longer holding periods or that I can give the benefit of the doubt in certain situations, then that's a different story.

I think honestly, most of it is based on intuition that comes from tons of experience. I've learned so much over the years from like I said, working side by side with Rai and Ross. However, nothing at the end of the day beats just day after day of seeing things play out and most importantly, being in multiple market cycles.

It's important that you've experienced a bear market, a bull market, a non trending market, you know, corrections, aggressive corrections. The more that the market throws at you over time and the more that you experience and go through, it just kind of ingrains itself inside of you as a trader.

In the beginning many many years ago, I would sit there and I would measure a base and I would say okay, is this a is this a perfect cup and handle? Is this a six week base is this XYZ. Now, I'm no longer doing that. I'm looking at itless mathematically or I should say, I'm not thinking in that sense. It's more of you know, I've seen this pattern 1000s and 1000s of time, and I have a good idea of how it's likely to play out. And so, since I have a very good idea of how it's likely to play out, I know the odds are in my favor.

This is just based off of the fact that I've seen this one pattern so many times so that confidence is built on repetition and experience.

I don't scale out at predetermined targets, something super important that us at TL always talk about is there's different phases as a trader and if you're not consistent yet, and you do set a profit target of 5% - you sell half at 5% and you move your stops up to even this is good, it takes money off the table and helps you solidify your profits and add structure to your trading. For me, though, it doesn't make sense.

I have no idea where the stock may or may not stop. I'm able to notice when the stock is losing strength and it's building a new base. Some traders, during these times will definitely sell and it's a good argument. It's essentially in those basing periods that could be weeks or months your money could be moved elsewhere with something with more momentum.

I have a longer term and slower approach and during those basing periods I am looking to hold my position and slowly accumulate a little bit more.

Adjusting After Losses

After a series of losses, I really don't make any adjustments. I look at it as feedback. So if I am getting multiple losses in a row, all of my new trades are failing. I'm not making progress. I'm pretty confident about what I do. So I'm not questioning myself at this point. It's more feedback from the market that it's not cooperative, or it's not a healthy environment for new positions, so I guess the adjustment you could say that I do make is, I scale back I get more defensive, which for me just means raising cash and being less active until things look better.

Emotional Management

Maintaining discipline now, for the most part is pretty easy. But it took a lot of pain and setbacks and losses and really, really bad decisions to ultimately build the discipline that I have now.

I think I was always looking at the market and everything as an opportunity and the thought that this next stock you don't want to miss out if it's a really big winner. That was a big struggle for me. But after, like I said, a lot of pain, a lot of setbacks. Eventually, enough's enough.

You either have to make a decision, am I going to stop trading or am I going to stop being an idiot? So after I stopped being an idiot for quite some time, or I should say ever again I started to see a much smoother equity curve.

It was way less volatile and it was way smoother and although it wasn't thrilling I was clearly seeing progress. And that progress really, really helps encourage you to keeping discipline because we all know the alternative.

I'll also add because some people find it interesting. As of the last year or two, I've removed intraday charts completely, so I'm only looking at weekly or daily charts. This really helps me not over trade as well. It doesn't make sense for my strategy. There's no reason really for me to be looking at those they just make me want to trade.

Understanding The Reasons Behind Early Struggles

For me, I think the biggest aha moment for me, it wasn’t one day it was a series of days or weeks months that kind of formed an aha moment. But mostly for me, I think like when I first started trading, I was obsessed with trying to outsmart the market.

I wanted to be the first one in and I wanted to buy a stock before anybody else bought it. And of course, we want to be the last one out so we're going to be the first one in and usually, when you think like this, you have a tendency to look for stocks that are near lows, because nobody else is really looking at them. They haven't started their move up yet. So when they're at lows, they have to move up near highs, right? Wrong.

Once I understood that, it's not about getting in first, but it's about getting in when the odds are in your favor.

I understood that institutions are the ones that move the markets, and they're not buying their positions in one day. Sometimes when they accumulate position that could take weeks or months. And so all you need to do is just identify when they do make a move, the odds are in your favor and follow their footsteps and these are always a stocks that are near highs and already making a lot of progress and never near 52 week lows.

Ranking setups - Relative strength, Liquidity & Multiple Edges

When I look at the market and there is countless setups, there are so many setups everywhere and I want to buy everything I don't have enough money. To me that feeling right there tells me that the market is probably pretty healthy right now. The odds based on my edge are probably in my favor.

So when I'm seeing a lot of stocks setting up and building or breaking out of bases and acting constructive and looking healthy, and I want to buy everything that on its own right there is a signal to get aggressive.

However, it is not a signal to get aggressive in the sense that you want to just carelessly buy everything that looks good. We really need to narrow it down to the best of the best. Each day when I go into the market, I have no more than six stocks max that I'm looking at.

These stocks are always the strongest stocks in the market that show relative strength. And I can't emphasize enough they are the big liquid leaders. Liquid meaning you can get in easy and you can get out easy and you don't have to worry about moving the stock on your way in or your way out. Worrying if there's going to be anybody to sell at the price that you're looking to get out at. These will make up about most of my portfolio and the rest of my portfolio to help hold those positions.

Like I said I hold through basing periods so to help hold those positions through minor pullbacks or basing periods, I'll use the rest of my capital and I'll actively trade what I like to call performance boosters, which are essentially just really technically strong stocks that may just be less liquid.

Most Common Trading Errors

There's so many common mistakes that new traders make. A lot of it comes from impatience. But a lot of that impatience, I think also comes from false expectations.

I think that there's a lot of misinformation out there from people with bad intentions that want you to believe that trading is a three step approach and that there's a science that they've figured out for it. And you learn with them, you're going to make a ton of money. And this couldn't be farther from the truth because as I mentioned before, everybody needs that experience.

You can learn from someone and speed up the learning curve. But first of all, you need to make sure you're learning from the right person to begin with before or you're just wasting your time.

Secondly, you need to have realistic expectations. One of the biggest things I see from new traders is that they're working a job, they don't have enough time to focus on the market. They want to quit their job and trade full time but they're worried that they're gonna be able to pay their bills with just trading alone and be consistent. And my answer to that is, if you're thinking about quitting your job to trade full time because you will make more money.… don't do it. (Unless you have a large account, another source of income, and a consistent track record)

More hours sitting in front of the computer aren't going to make you a better trader. It's all about preparation. It's about the preparation you do outside the market or when the markets open. You honestly don't really even need to be sitting in front of a computer is just going to cause you to make a lot more trades that you don't need. And it's all just because you don't have a system.

One more thing that I want to add is I make money in certain markets, and I don't make money in other markets.

For example, last year the market was trending down the whole year I didn't short, I sat in cash and so among a market like last year, there's short periods of time where you can make money, but other than that, I'm not really making money at all.

There's a market that fits my trading like 2020 when it is a lot healthier and in a strong uptrend.

Understanding environment and understanding which market environments are cooperative with your strategy, understanding when to be active and when not to be active. These are all things that new traders have to learn and the faster they learn much quicker they'll speed up their learning curve.

Most Important Trading Rules

Number one, always manage risk. If you're not managing your risk, it does not matter how well you're doing or how much money you make because luck always runs out. And if risk is not being managed you will lose everything. All it takes is one undisciplined trade to ruin months or even years of your hard work.

Another personal rule for myself is, I noticed that a lot of my time when I started trading was spent on when the market was open. I was excited and I had a thrill and I was looking for a trade and that is totally not the way to do it. So a personal rule for myself is now when the markets open, if it's not a stock from my focus list that I had from preparation the night before, then I'm not looking at it.

Success comes from preparation. The more I prepare when I trade, the better I do. And so I do all my preparation, identify what I want to be looking at. And so that's all I'm looking at when the markets open and it really helps me focus. I have more free time and stop chasing everything that moves and looks good.

Recent Trades

(5th September)

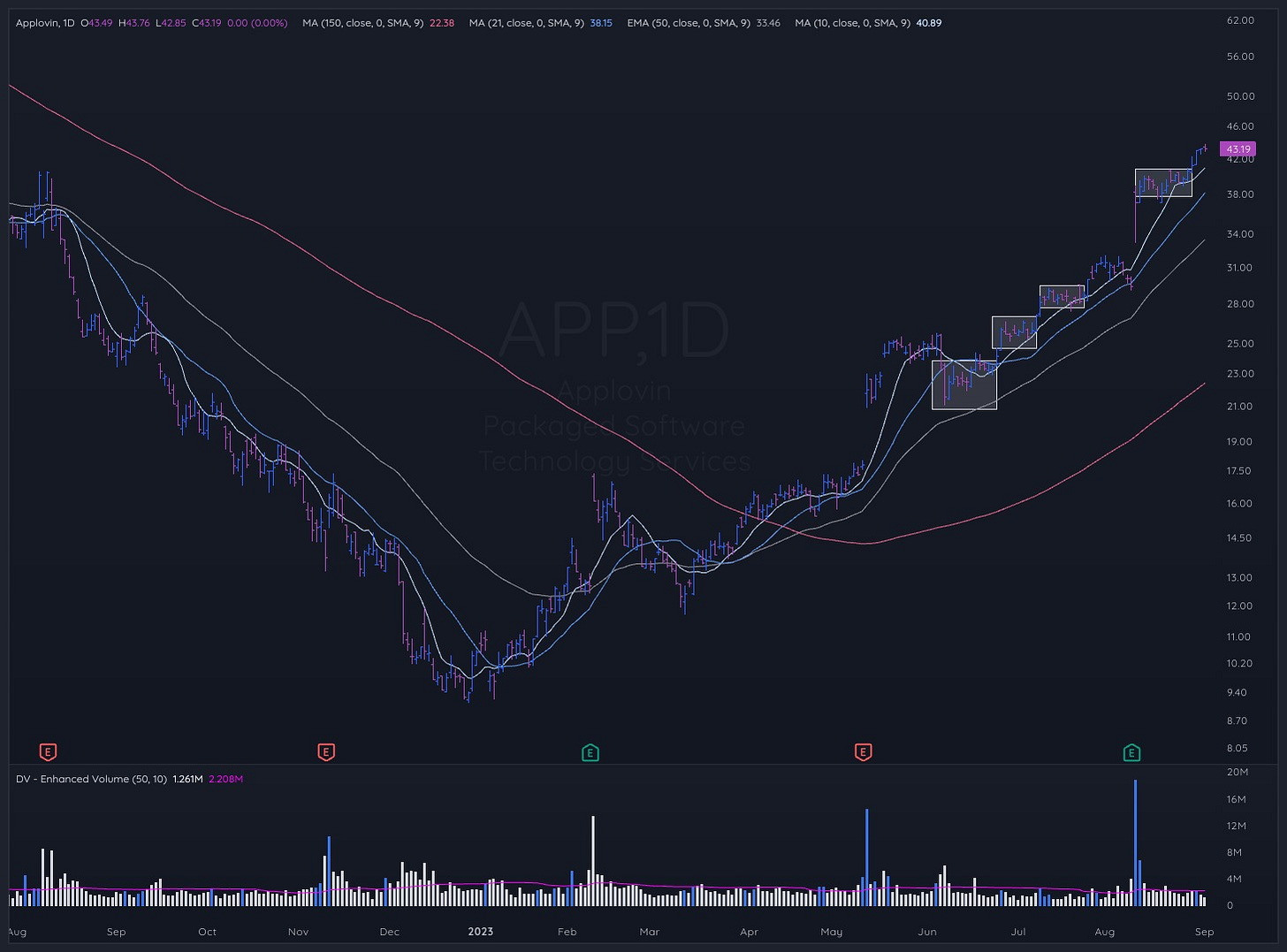

The first chart is my APP position.

It showed up on my character change scan on the weekly making a higher low and crossing the 10 & 30 week.

The chart here is a daily to show more detail. Each of those white boxes were opportunities for me to build a position.

I buy in zones and pieces not all at once. As long as it is within those small tight ranges and showing strength and support on the 10/21 dma it was showing insane strength on the days it mattered most so I would buy some.

As I’m writing this, it is an open position so I have no idea how the trade will close but I keep moving my stops up along the way. How much exact wiggle room I will give it matters on the context of the market environment at the time and the characteristics of the pullback.

If we pull back quick and fast on massive volume I will cut my position quicker than if we constructively and slowly pull back to the 21 or 50 dma.

A nice loss I handled was YEXT.

It gapped up on the highest volume ever, what TL calls HVE.

This is a high probability setup when you have big gap ups on the biggest volume ever and strong closing range >50%.

I bought this stock after the gap up after I clearly measured my risk and the point where my thesis is wrong. For me that was 12.50.

I like to share this trade for two reasons:

One is it looks technically perfect, had all the ingredients, and failed miserably.

Two is you can see if I stayed wrong and held past my exit point I would have had a lot of damage to my account.

My most recent no discipline, mishandled trade was in 2018.

I got way too involved and hooked on the story behind VKTX and I let it blind my judgement and override my rules.

This stock gapped up 120% over night and I had a big position. I recognized my exit area after the gap where if it was to break, my position would be invalidated, so in theory my risk was managed and this was just another trade.

Long story short I kept rationalizing why I need to give it more room and give it time and I ignored my rules and what I was seeing right infront of me because I was too blinded by the story of the stock.

Because of this careless and undisciplined decision I ended up at one point being up a total of 150% and sold my full position not much above even.

Painful, at this point in 2018 I wasn’t making mistakes like this, I honestly never thought in a million years I could do something like that but hey I did it and I learned a ton and you bet I’ll never let it happen again.

Would just like to show my gratitude to Nick for finding the time to share some important lessons learn throughout his trading journey!

Be sure to check out some other helpful interviews:

Oliver Kell Interview: The Mind & System Behind a +941.10% Year

I am really excited to be putting out this interview with Oliver Kell, a renowned stock trader who made headlines in 2020 by winning the United States Investing Championship with a staggering 941.10% return.