Clearly out of the sweet spot here and finding difficulty dealing with the underside of the 50-day moving average. Don’t need to look much further than this chart below to understand that this current market environment is not as supportive of breakouts:

50 Free Charts 📈

Check out my website here for a FREE gift - stockbsessed.com

General Market Overview

QQQ 0.00%↑ Inside day which got rejected intraday as sellers came in right at the 50-day to push this lower and close the session down -1.06%:

SPY 0.00%↑ Similar to the QQQ is weak and now closed the session below the 50-day and this prior area of interest around 444:

ARKK 0.00%↑ Inside day which closes poorly in line with the recent weakness this has been showing as this continues trending below KMAs:

IWM 0.00%↑ breaks below last session’s low and closes right near the lows of the day, below this important area around 189 and the 50-day:

Leading Stocks Analysis

I am linking the leaders watchlist in tradingview for your convenience, here

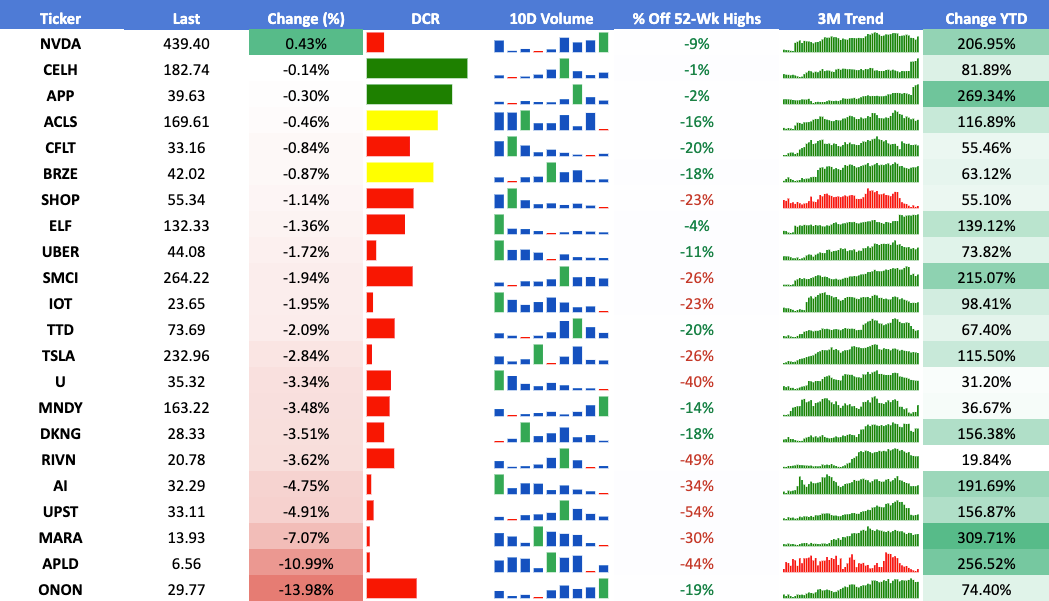

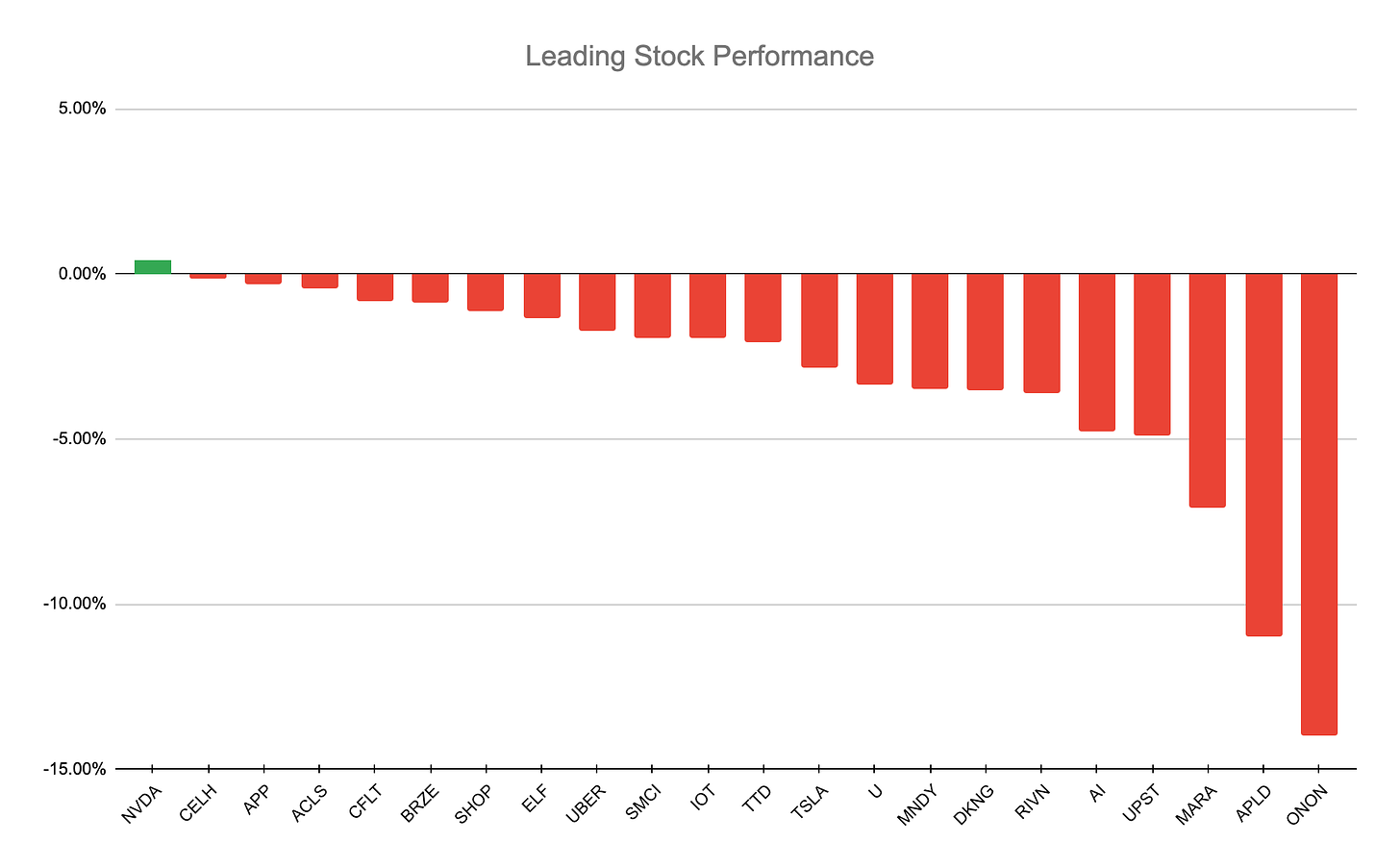

Says a lot about the current market when the average performance of the components above over last session was -2.53% with NVDA 0.00%↑ being the only one that closed positive on the session.

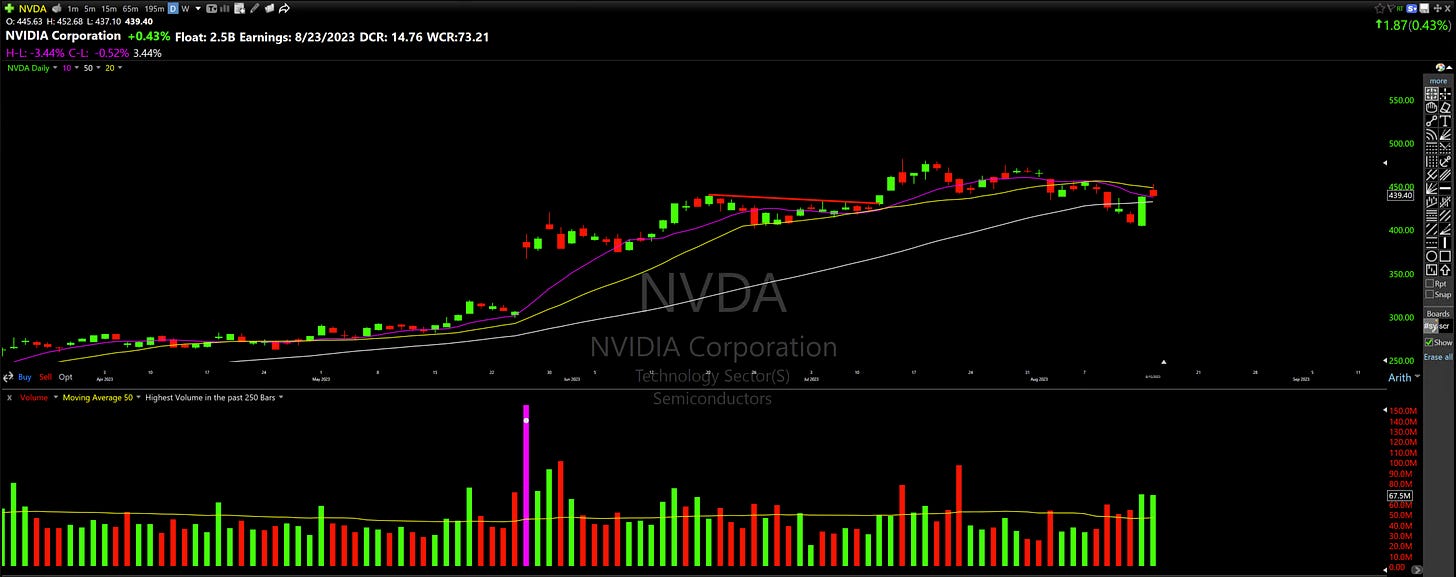

NVDA 0.00%↑ Poor daily closing range to end the session near the lows of the day however supported by the 10MA as of now. 20MA acted as resistance throughout last session and a failure to hold the 10-day could lead to new recent lows:

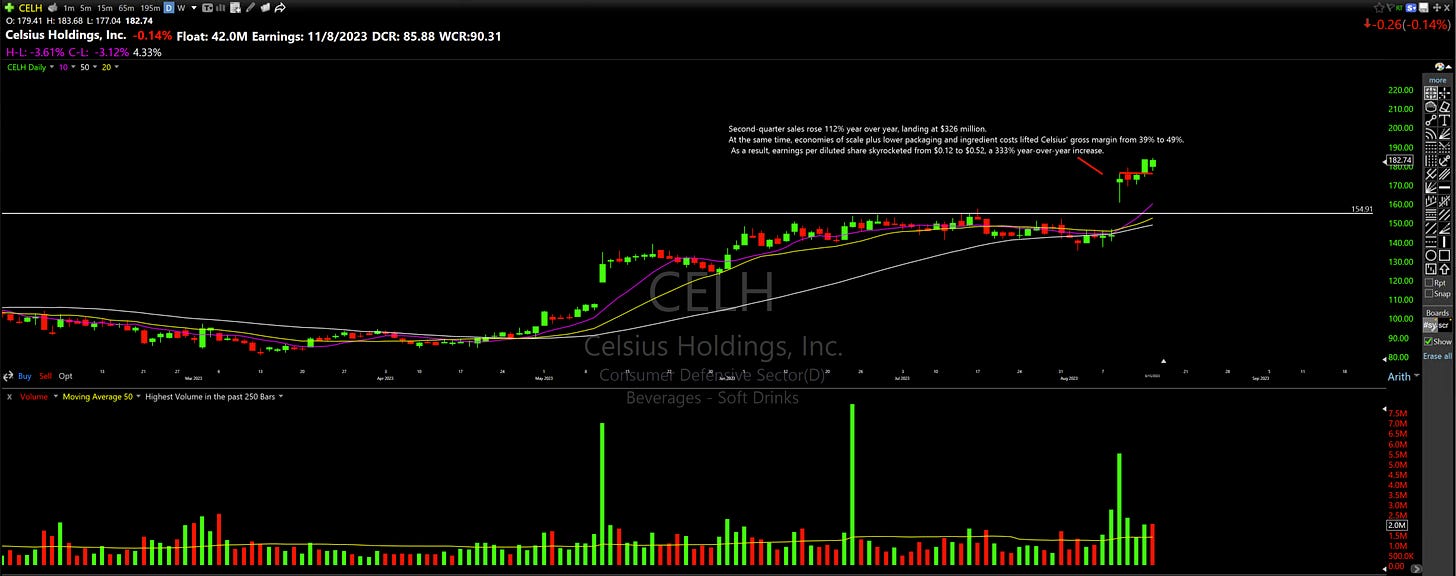

CELH 0.00%↑ Excellent action here since gapping up on earnings - like how this traded tight for 2 sessions and then pushed out once more quickly with successive strong closes:

APP 0.00%↑ Another strong name since the recent earnings-related gap-up here - would like to see this flag out and trade tighter until allowing KMAs to catch up to price:

BRZE 0.00%↑ Building out a topside pivot here around 43 while tightening up right below the 20-day. Inside day last session to close just above the 10-day and 50-day:

No shortage of recent weakness and rejections around declining key moving averages SHOP 0.00%↑ SMCI 0.00%↑ TSLA 0.00%↑ AI 0.00%↑ MARA 0.00%↑

ONON 0.00%↑ Follows through on the weakness seen here since the failed breakout a few sessions ago to gap down and close -13.98% on the session:

In the following sections of the daily plan I go over additional research in preparation for the next session:

✅ Individual sector analysis

✅ 4 Scans with results to get stocks with leadership qualities on our radar

✅ Personal Portfolio Update

✅ Stocks currently on my focus list with actionable trade ideas - The best setups from a risk/reward perspective

Individual Sector Analysis

Keep reading with a 7-day free trial

Subscribe to Stockbsessed to keep reading this post and get 7 days of free access to the full post archives.