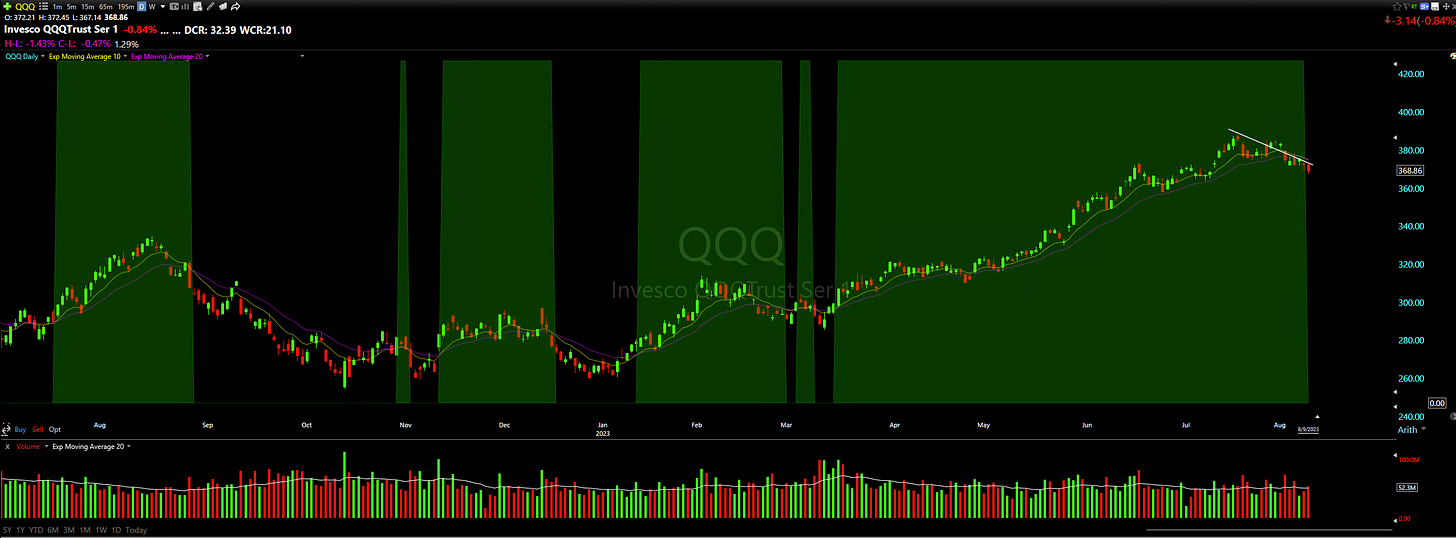

QQQ 0.00%↑ In case you’ve been wondering why it’s become harder to make any progress, or why your last few trades have not been working out - see this chart below.

Clearly shows that we are now out of the sweet spot where the 10 day would be trending upwards above the 20-day, indicating a less breakout-friendly environment and one which is harder to make progress in.

Trading is more than just about identifying setups, managing risk and seeing from there - it requires you to be in tune with market and have strong situational awareness, know when your setups are in favour and when they are not, only then should you show up to take that opportunity:

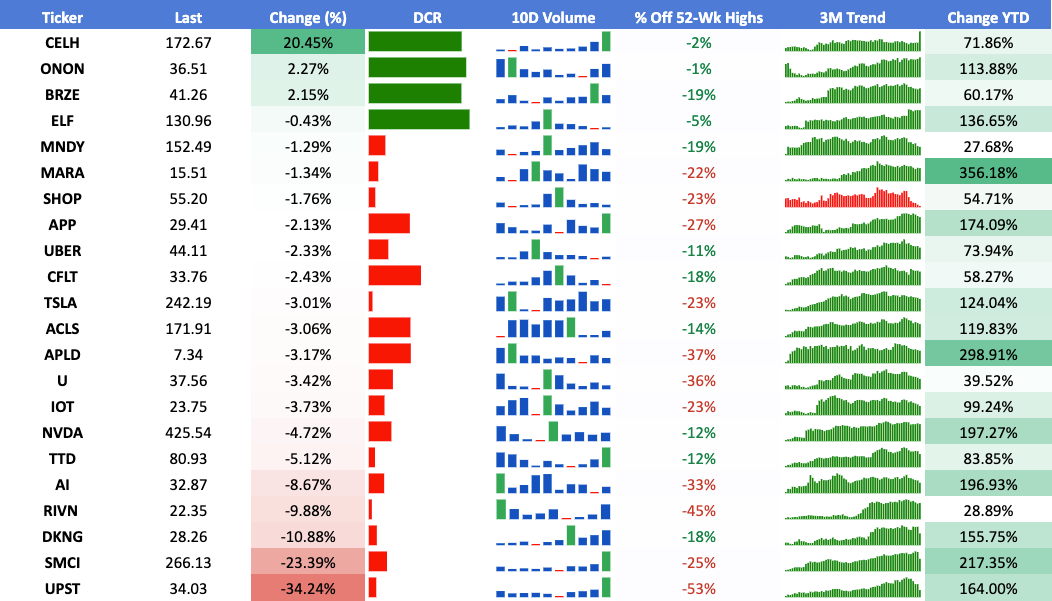

A continuation of the most recent deterioration in breadth as new lows continue outpacing new highs for large caps, mid caps and small caps:

Have little to no interest trading this market environment unless something big shows up - wind is clearly not in our backs and even if this changes quickly, would like to see an abundance of sound setups before looking to get aggressive

Momentum Watchlist

I am linking a watch list with around 150+ recent momentum leaders that I am watching closely, here

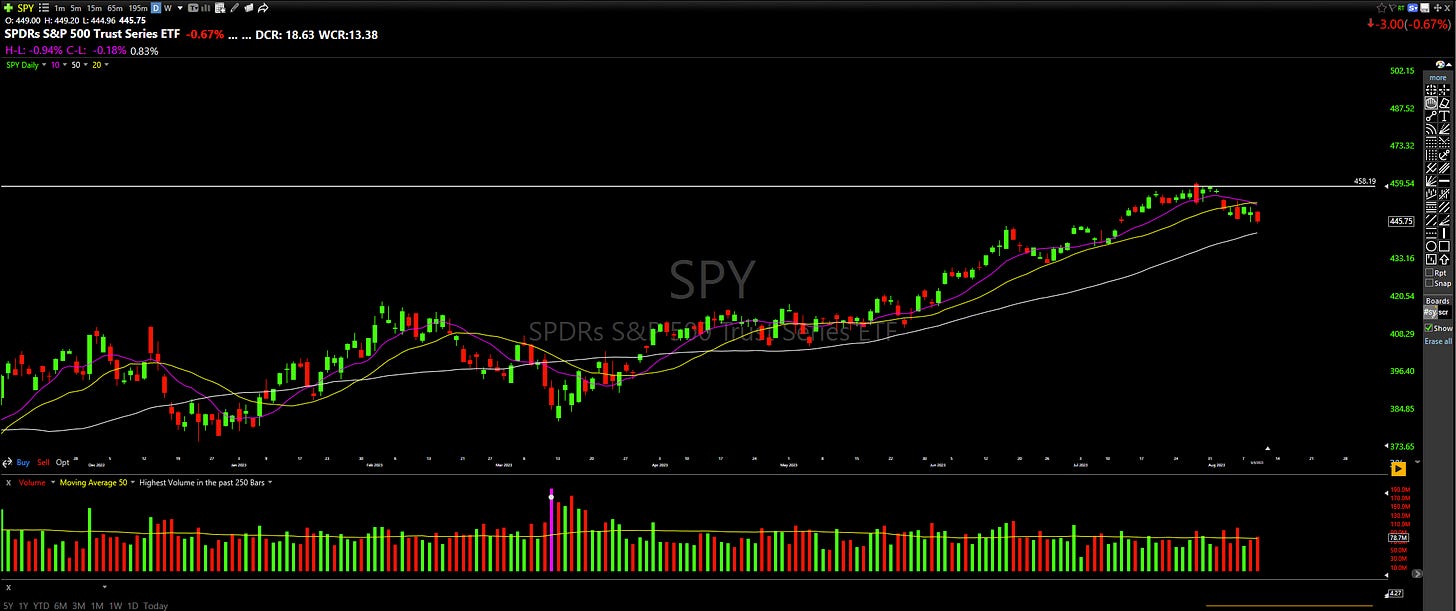

General Market Overview

SPY 0.00%↑ 10 day now crossing below the 20 day and showing that momentum is stronger to the downside - a test of the 50-day seems likely here and would be a key area to watch for buyers to show up:

ARKK 0.00%↑ Poor close at the lows of the day and now below all KMAs - shows how it pays to be involved with the market when a strong technical backdrop is present - the wind is in our backs when trending upwards:

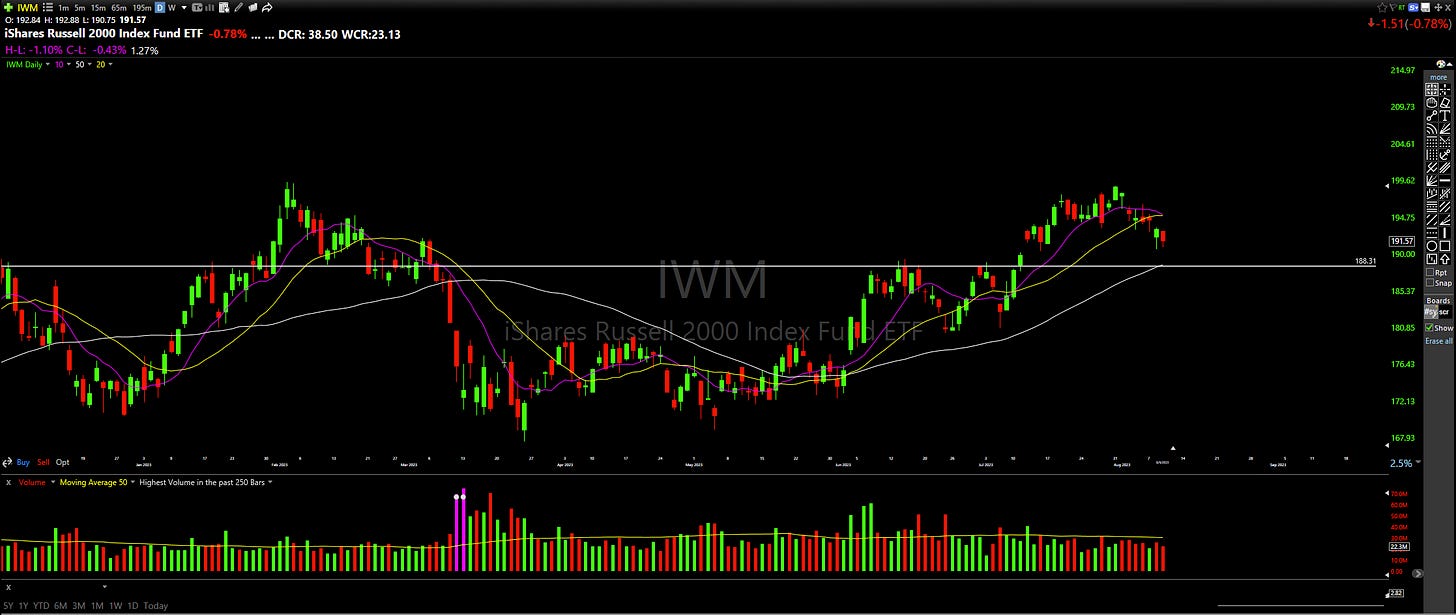

IWM 0.00%↑ Inside day on the session below the 10/20 MAs while above the 50-day. Stuck in no man’s land here - a pullback to this area of prior resistance around the 188 area which corresponds with the 50-day may welcome buyers:

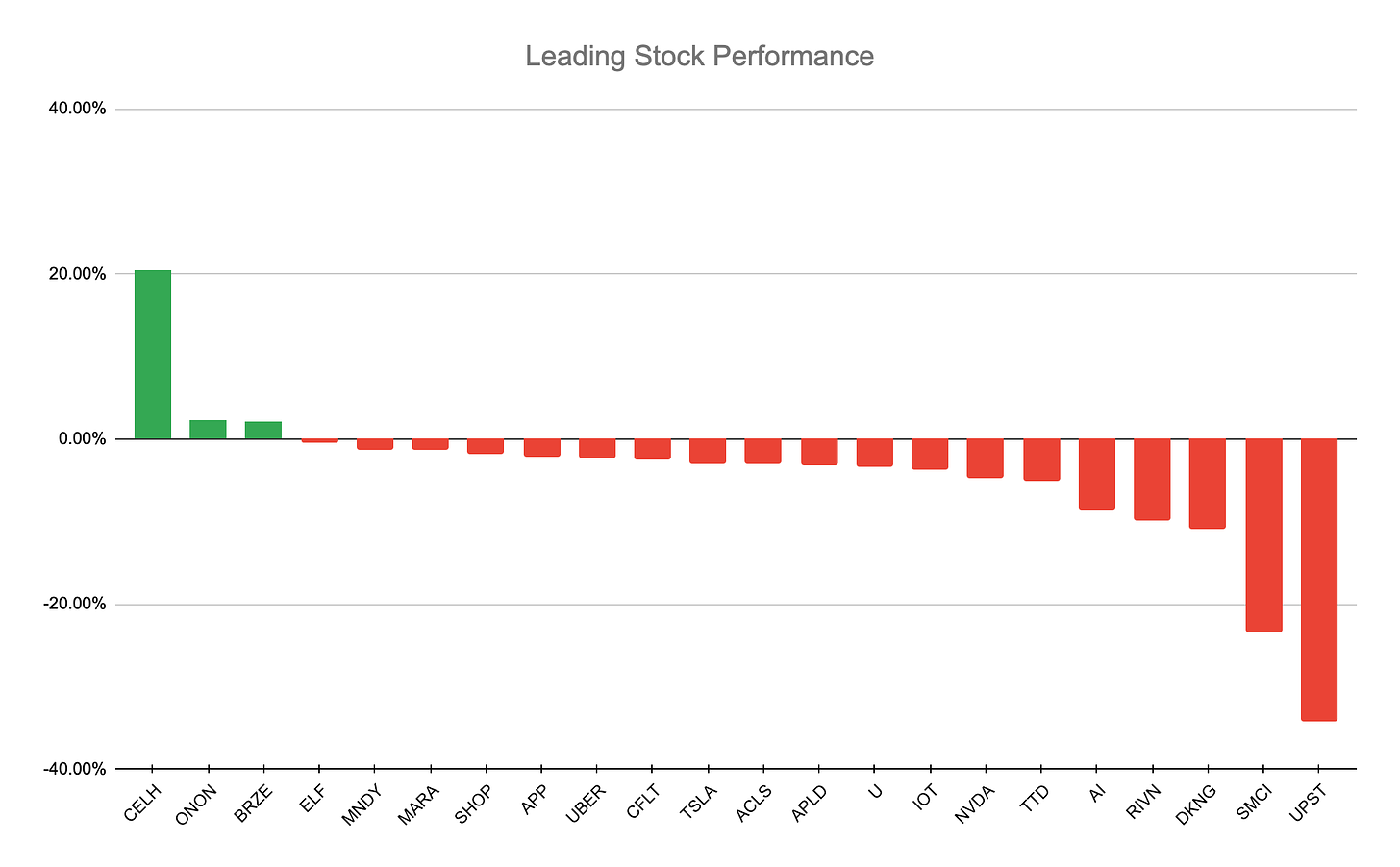

Leading Stocks Analysis

Average performance: -4.55%

I am linking the leaders watchlist in tradingview for your convenience, here

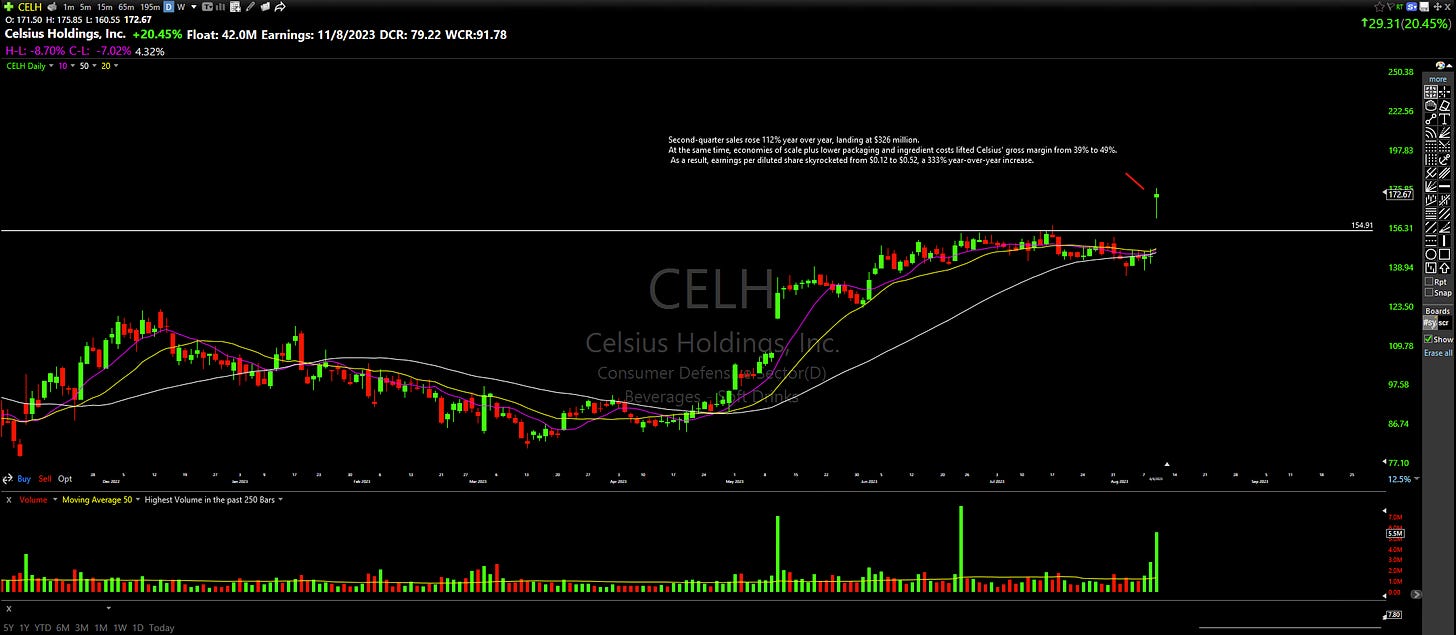

CELH 0.00%↑ Excellent response to very impressive earnings last session and good to see this gap up and close strong - few names have been responding so well to their earnings reports and would ideally like to see this tighten up over the next few sessions:

ONON 0.00%↑ Pulled in nicely to the 20EMA while resting above this area of prior resistance around the 34 spot and tightened up well - now trying to turn back up as it pushed above this descending trend line last session:

ELF 0.00%↑ Just flagging out since the most recent earnings-related gap-up without giving much back, allowing the 10-day to catch up to price here:

MNDY 0.00%↑ Not a great look for this one when the 10 and 20 day are crossing below the 50-day and all KMAs are now declining along with price - sellers clearly in control here and now -20% off the recent highs in just a few sessions:

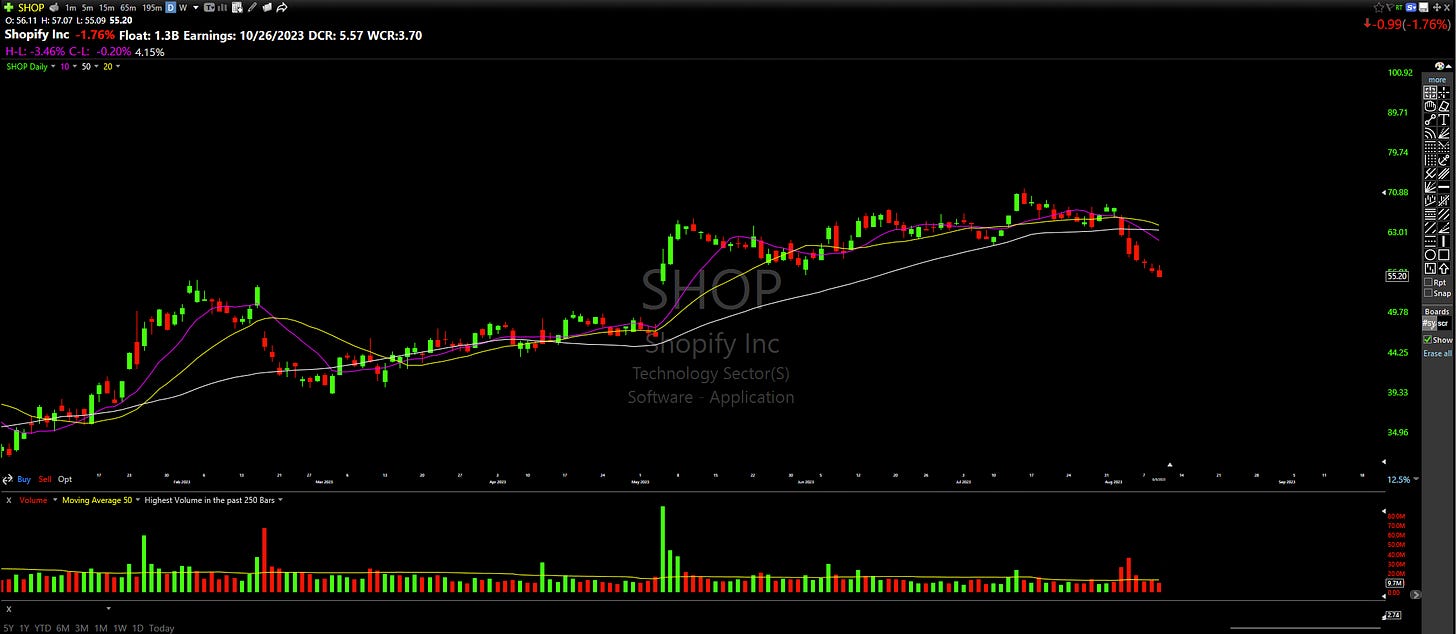

SHOP 0.00%↑ Similar to above:

UBER 0.00%↑ NVDA 0.00%↑ At important areas here as we are witnessing the first test of the 50-day after some impressive runs - some say that the first visit to the 50 day after a big breakout is a gift, but only time will tell:

AI 0.00%↑ More distribution with a -8.67% session to close once more below all declining KMAs - 10/20 MAs about to cross down below the 50-day as we approach a key area of previous support just under the 32 spot:

SMCI 0.00%↑ Speculative money comes in quickly but leaves just as fast - a quick +280% run followed by this most recent gap-down in response to earnings. Closed the session below all KMAs with a poor DCR:

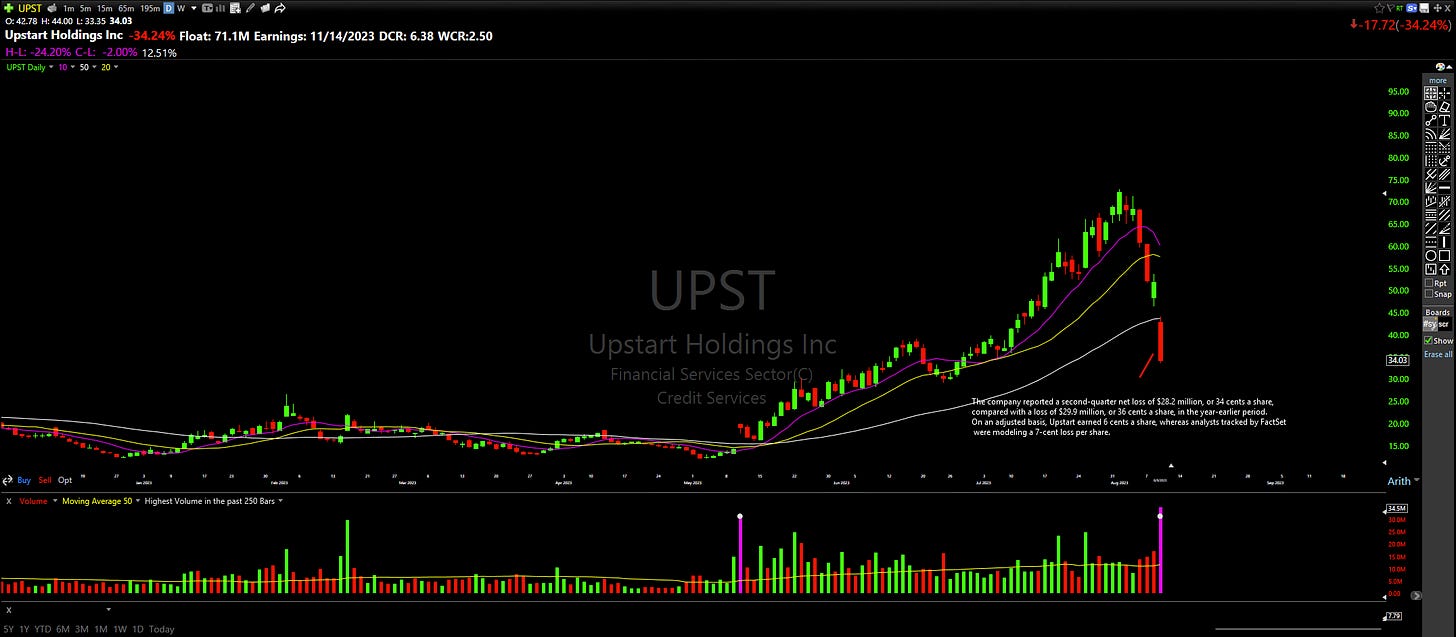

UPST 0.00%↑ Similar to SMCI 0.00%↑ as this had a +500% run in a few months and is now -54% off the highs in just a few sessions:

In the following sections of the daily plan I go over additional research in preparation for the next session:

✅ Individual sector analysis

✅ 4 Scans with results to get stocks with leadership qualities on our radar

✅ Stocks currently on my focus list with actionable trade ideas - The best setups from a risk/reward perspective

Keep reading with a 7-day free trial

Subscribe to Stockbsessed to keep reading this post and get 7 days of free access to the full post archives.