Have little to no interest trading this kind of market - very few sound setups and unlikely to make significant progress when the odds are stacked against me - waiting for a healthier market backdrop and avoiding chopping up my account:

50 Free Charts 📈

Check out my website here for a FREE gift - stockbsessed.com

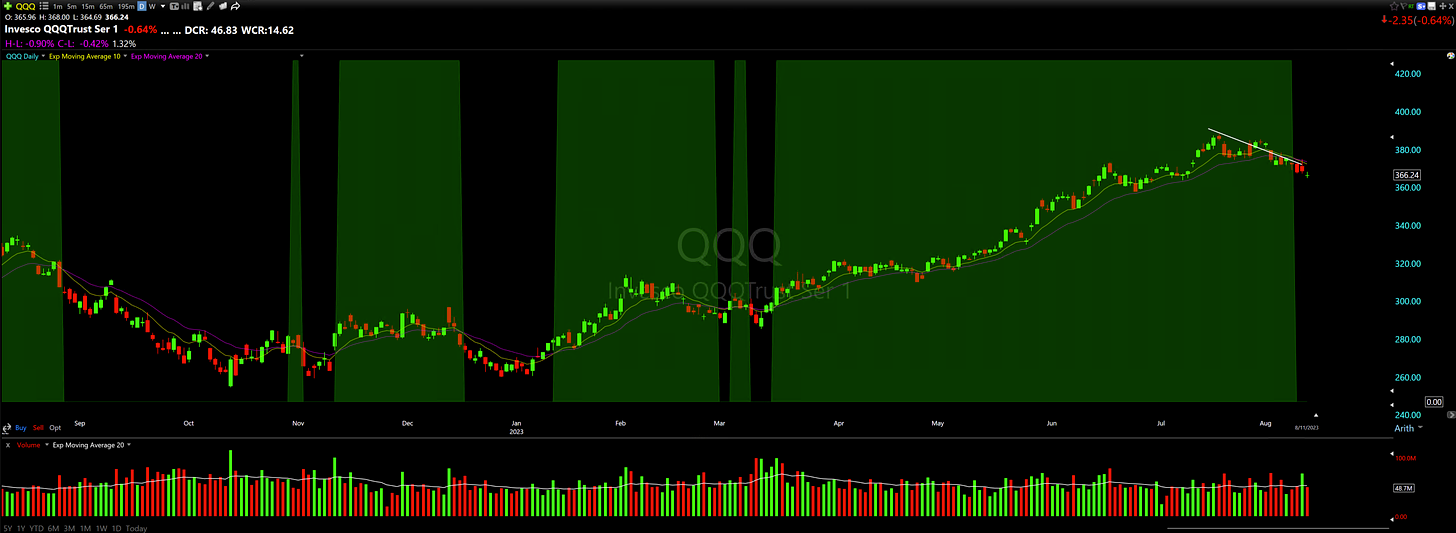

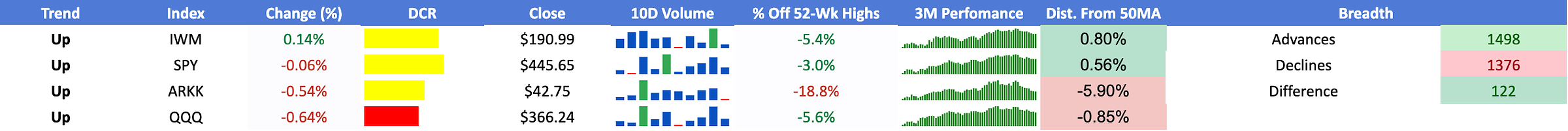

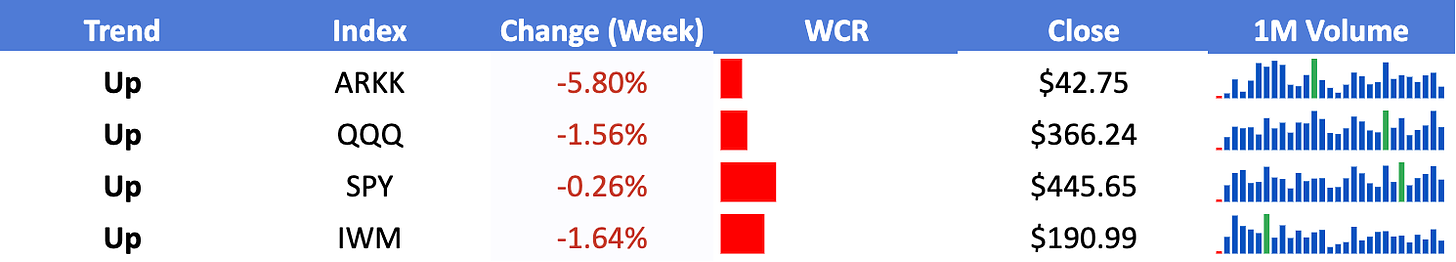

General Market Overview

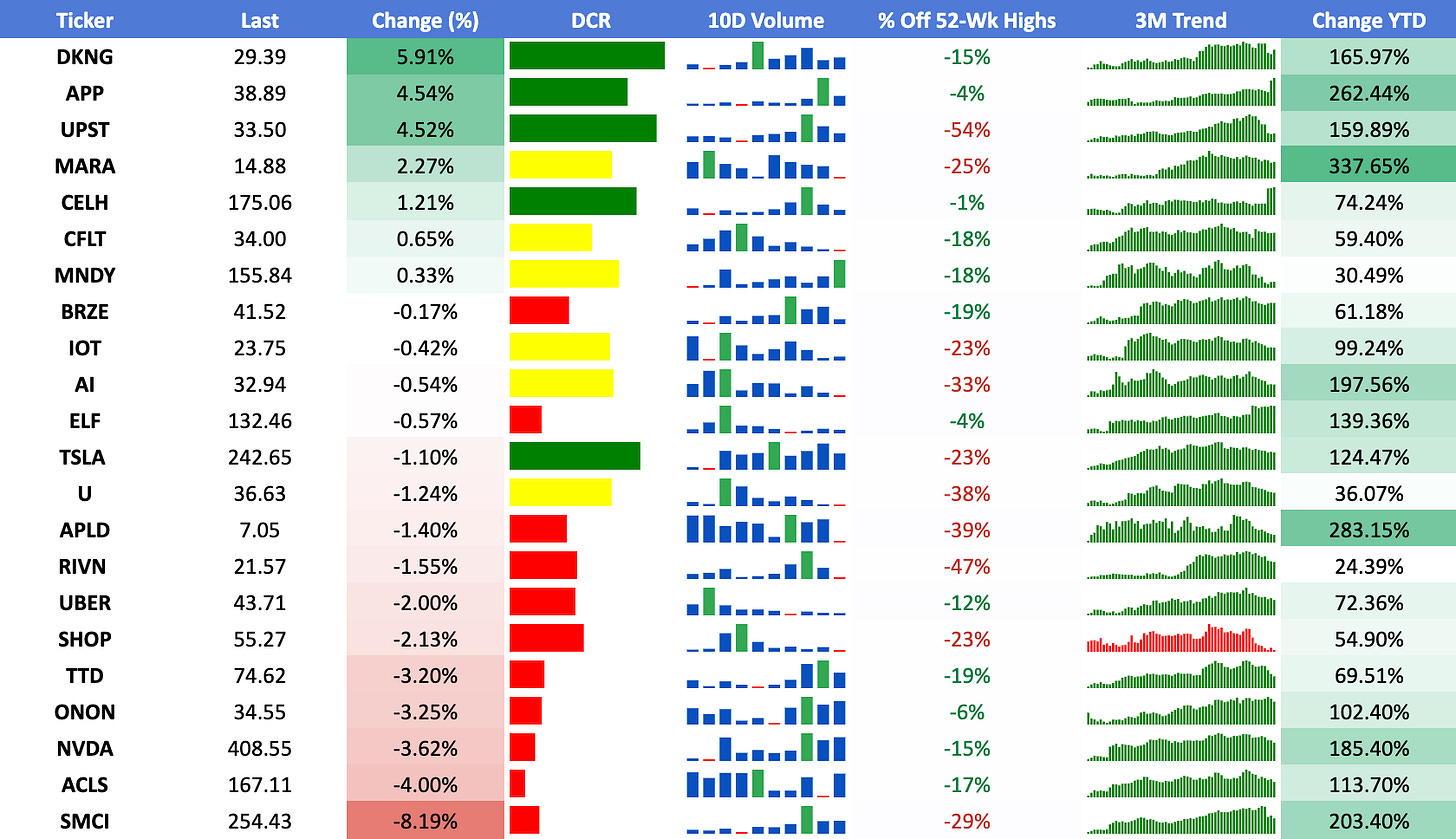

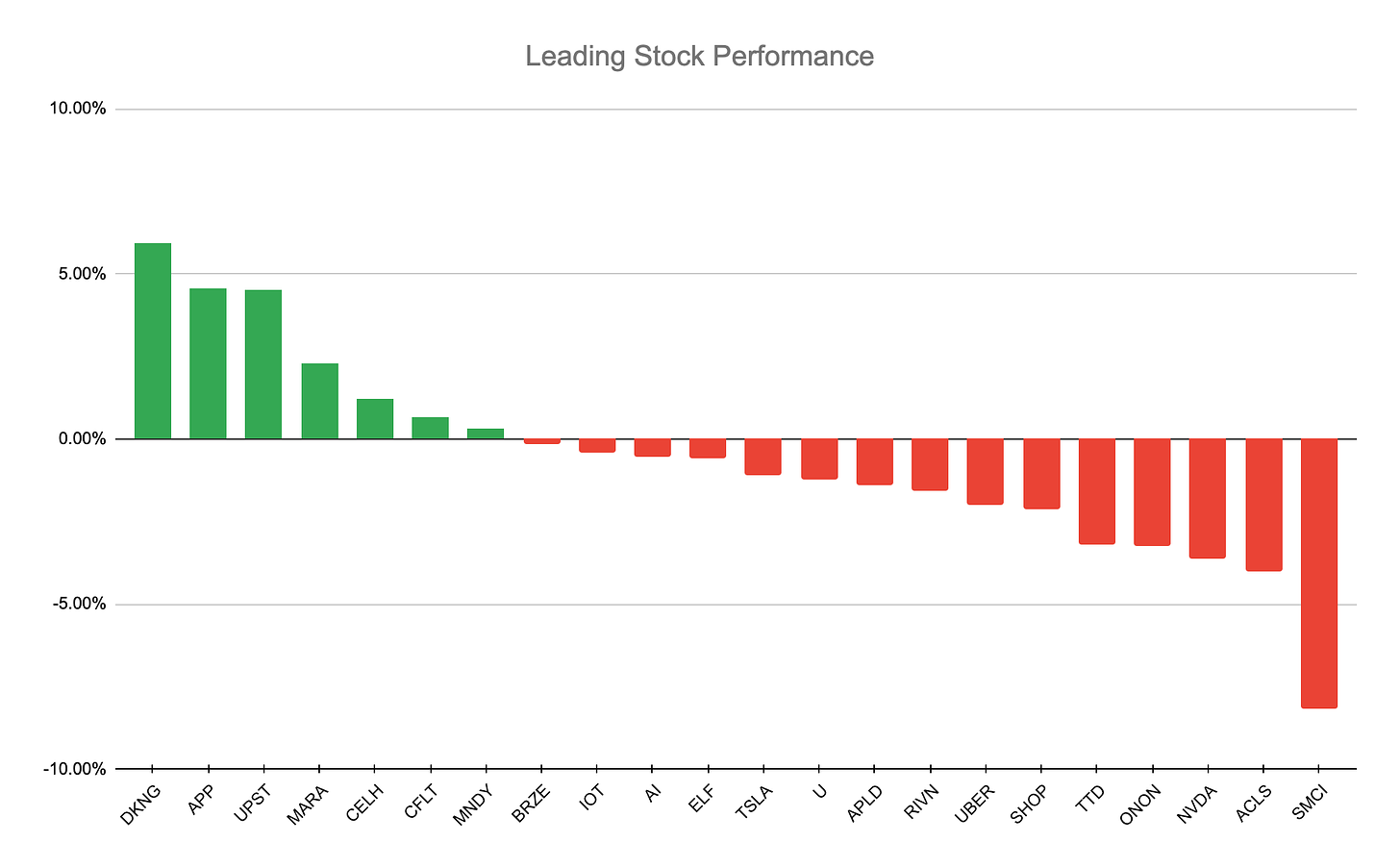

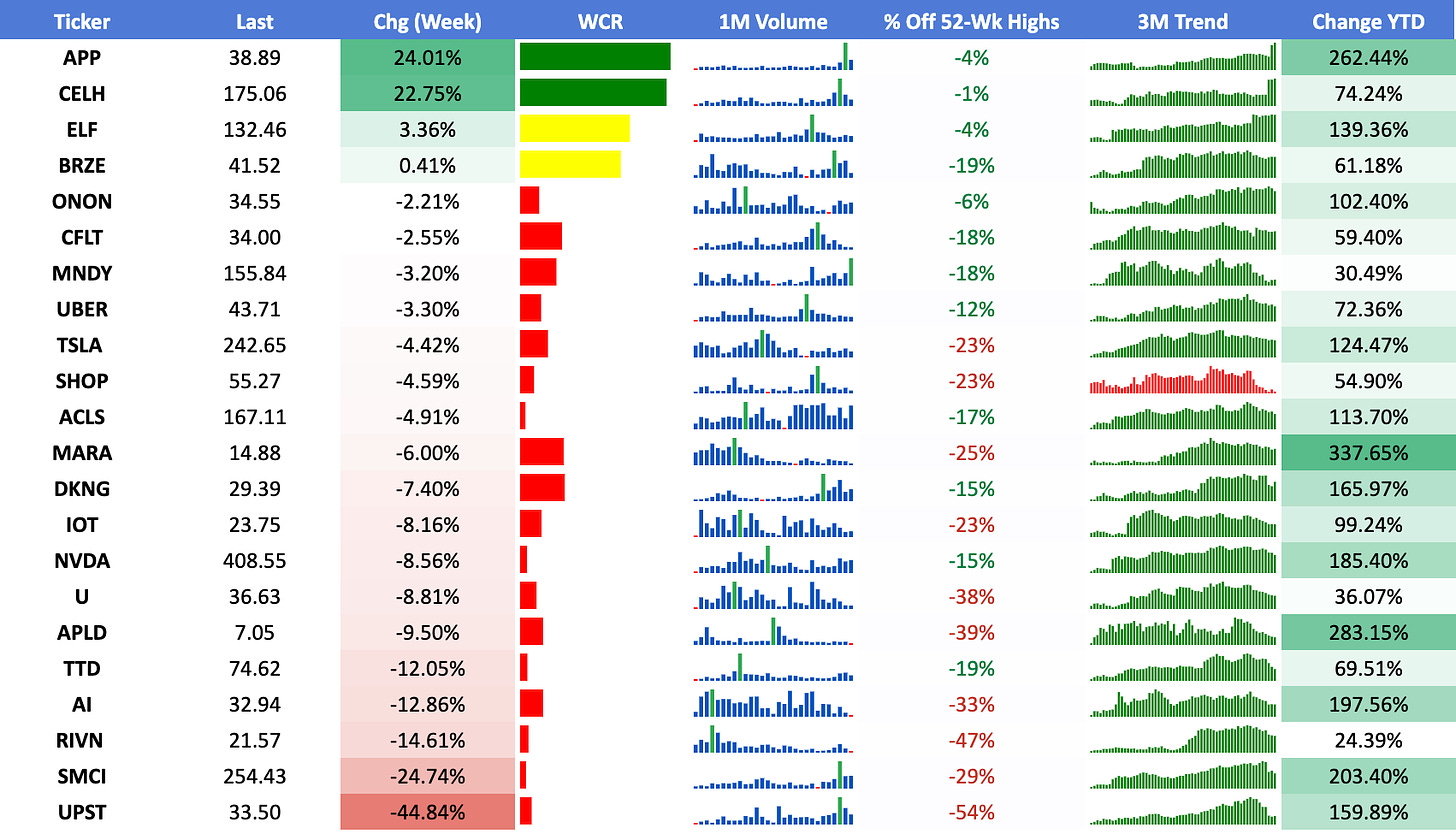

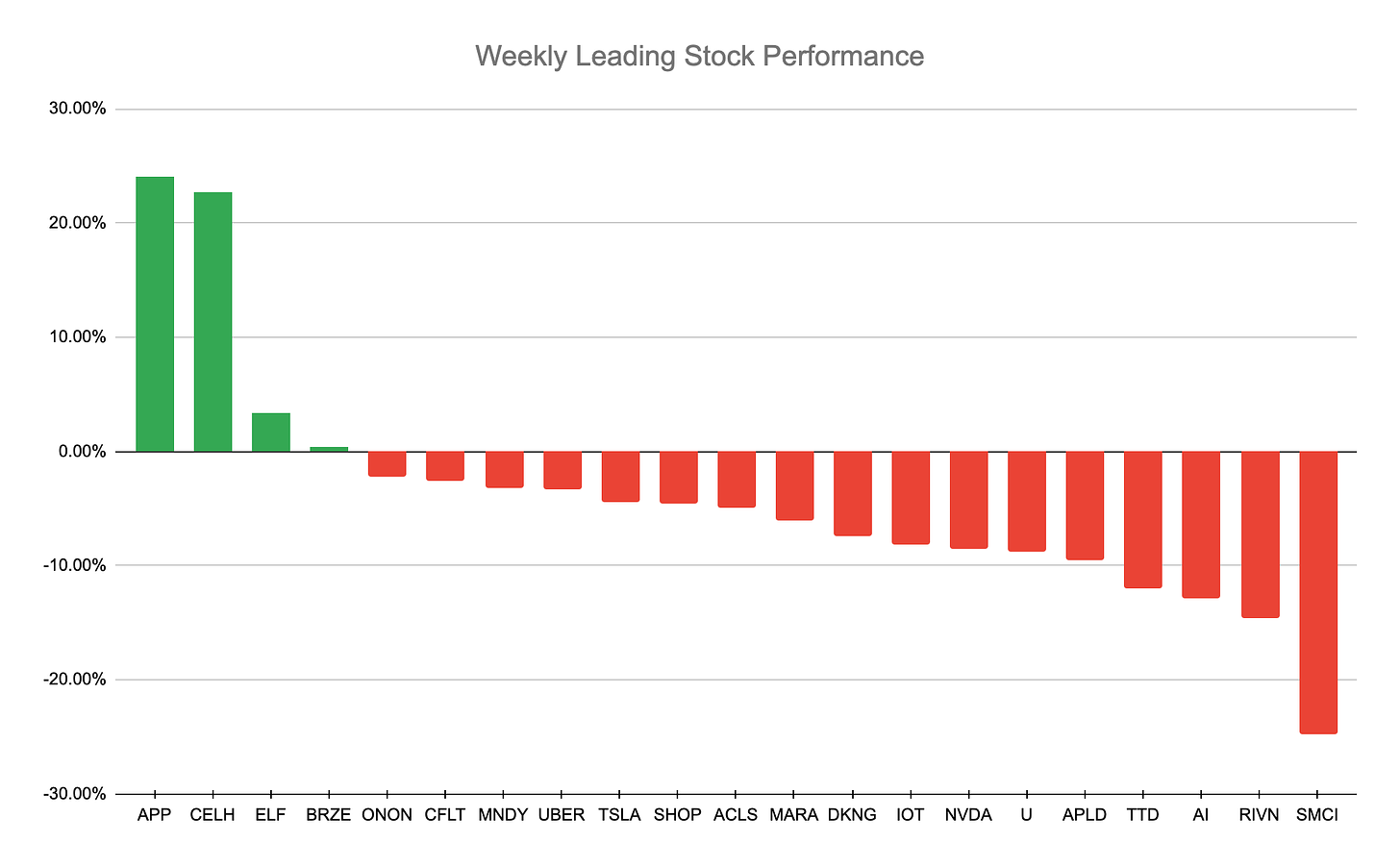

Leading Stocks Analysis

Average: -0.63%

I am linking the leaders watchlist in tradingview for your convenience, here

DKNG 0.00%↑ One of the only ones to have a positive reaction to a key moving average - most of this list fell further over the course of last week to lose key areas and close below them, however this one had some strong buyers show up at the 50-day to close the session +5.91% going out near the highs of the day on above average volume:

APP 0.00%↑ Strong action this week as it gapped up on earnings and then followed through to close strong last session - weekly shows that we are moving away from a large base by clearing key areas of resistance around the 25 spot:

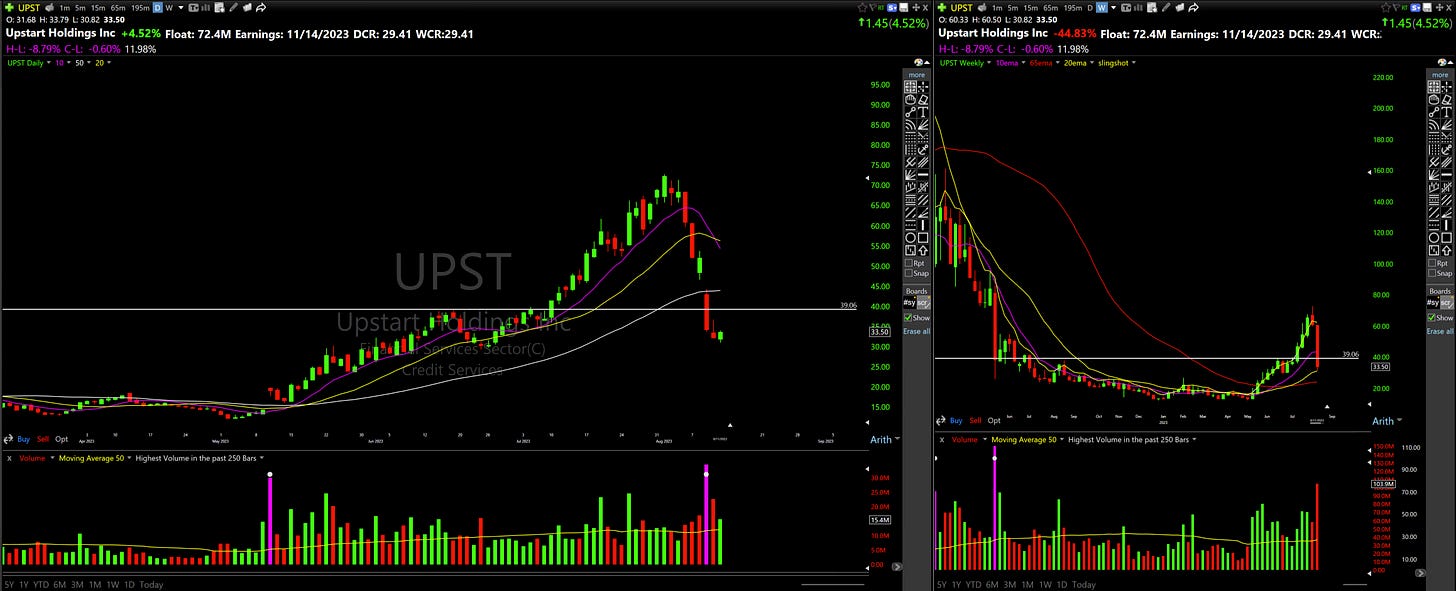

UPST 0.00%↑ Complete loss of upward momentum in this name here after a negative response to the most recent earnings report to end up -60% off the most recent highs in just a few sessions:

MARA 0.00%↑ Like how this is being supported at the 50-day / 10WMA as of now, would like to see this tighten up a few more days here and then offer a buyable pivot:

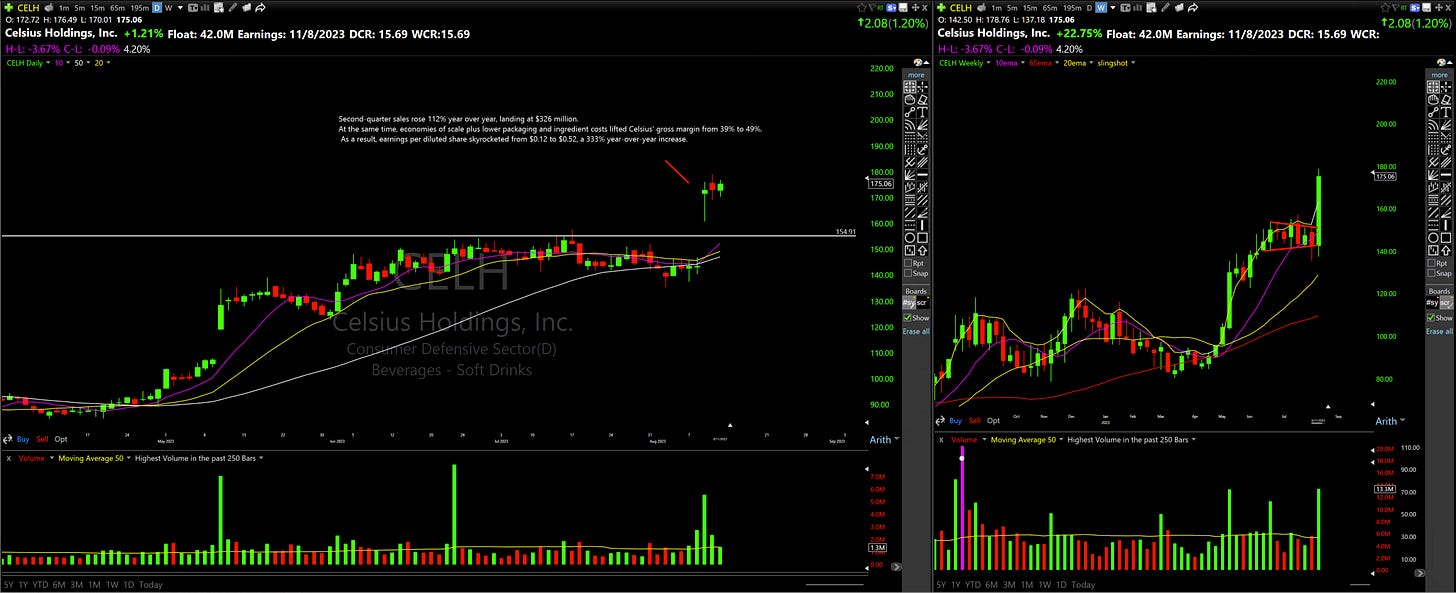

CELH 0.00%↑ With a strong response to earnings and some good action following that - like how the last 2 sessions have been controlled with a tight inside day last session:

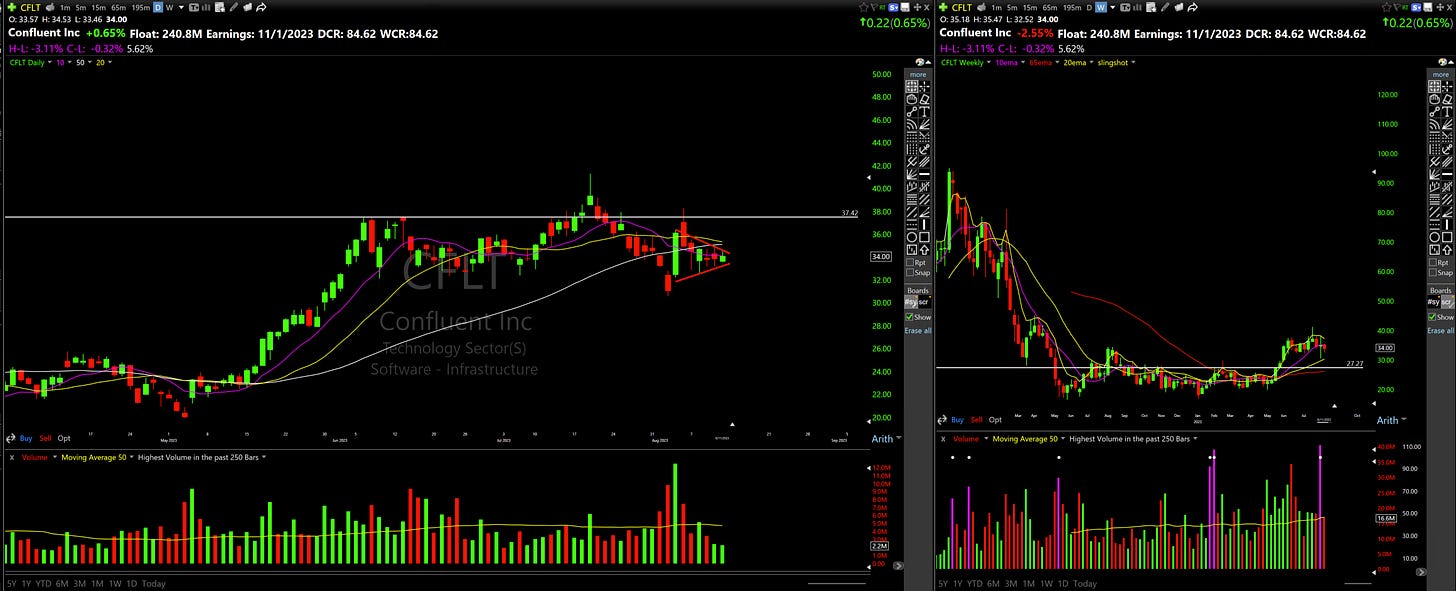

CFLT 0.00%↑ Had a failed breakout recently and struggled to get going after - has been acting well since the most recent earnings report around 3rd August and is now tightening up nicely over the last few sessions:

BRZE 0.00%↑ A younger name consolidating below this key level on the weekly around the 45 area - daily shows a rejected right around the 10MA last session:

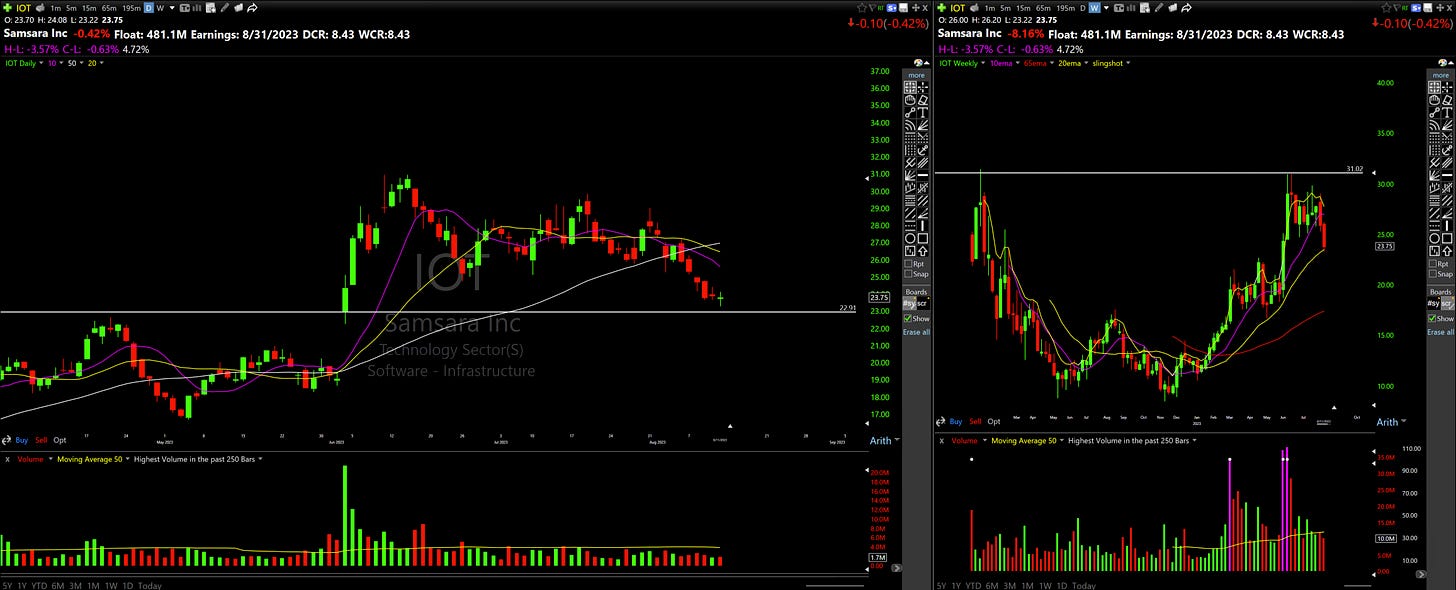

IOT 0.00%↑ Approaching the most recent earning’s gap up low here and currently below all key moving averages - shows how quick things can change as this went from consolidating right at the highs of this large IPO weekly base to -25% off the highs:

AI 0.00%↑ Now approaching the lower end of this large range with key moving averages declining:

TSLA 0.00%↑ Not the best sign for the general market and overall growth trade when TSLA looks like this - continues its recent downtrend below key moving averages - a positive is that sellers tried to break this down from the most recent 4 session range but all things considered this closed pretty well:

U 0.00%↑ SHOP 0.00%↑ TTD 0.00%↑ NVDA 0.00%↑ SMCI 0.00%↑ Similar to TSLA 0.00%↑ as they continue their downtrend:

ONON 0.00%↑ Recent failed breakout led to additional weakness here and is now below the 10/20 MAs while retesting highs of this prior base around 34:

Average: -6.01%

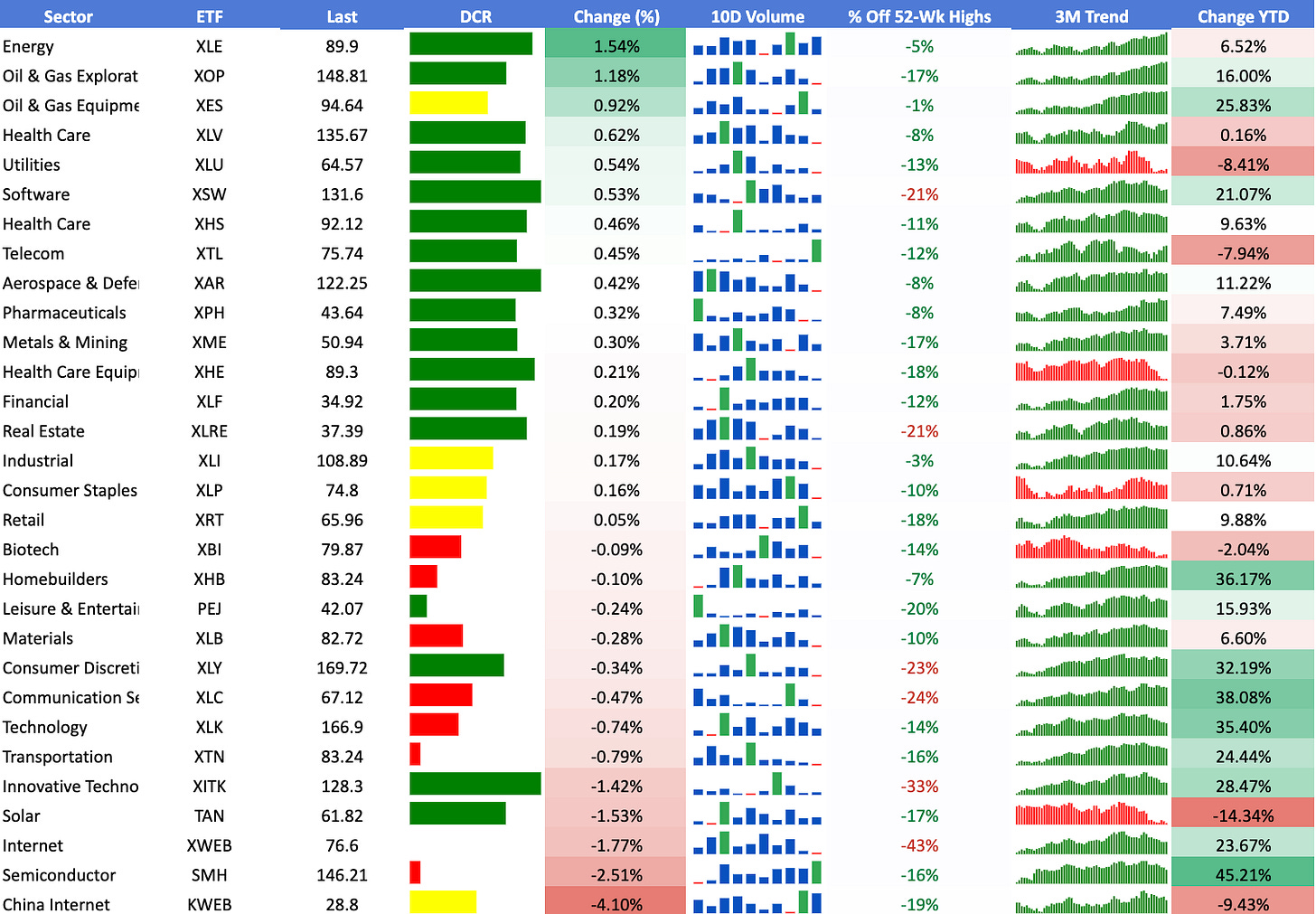

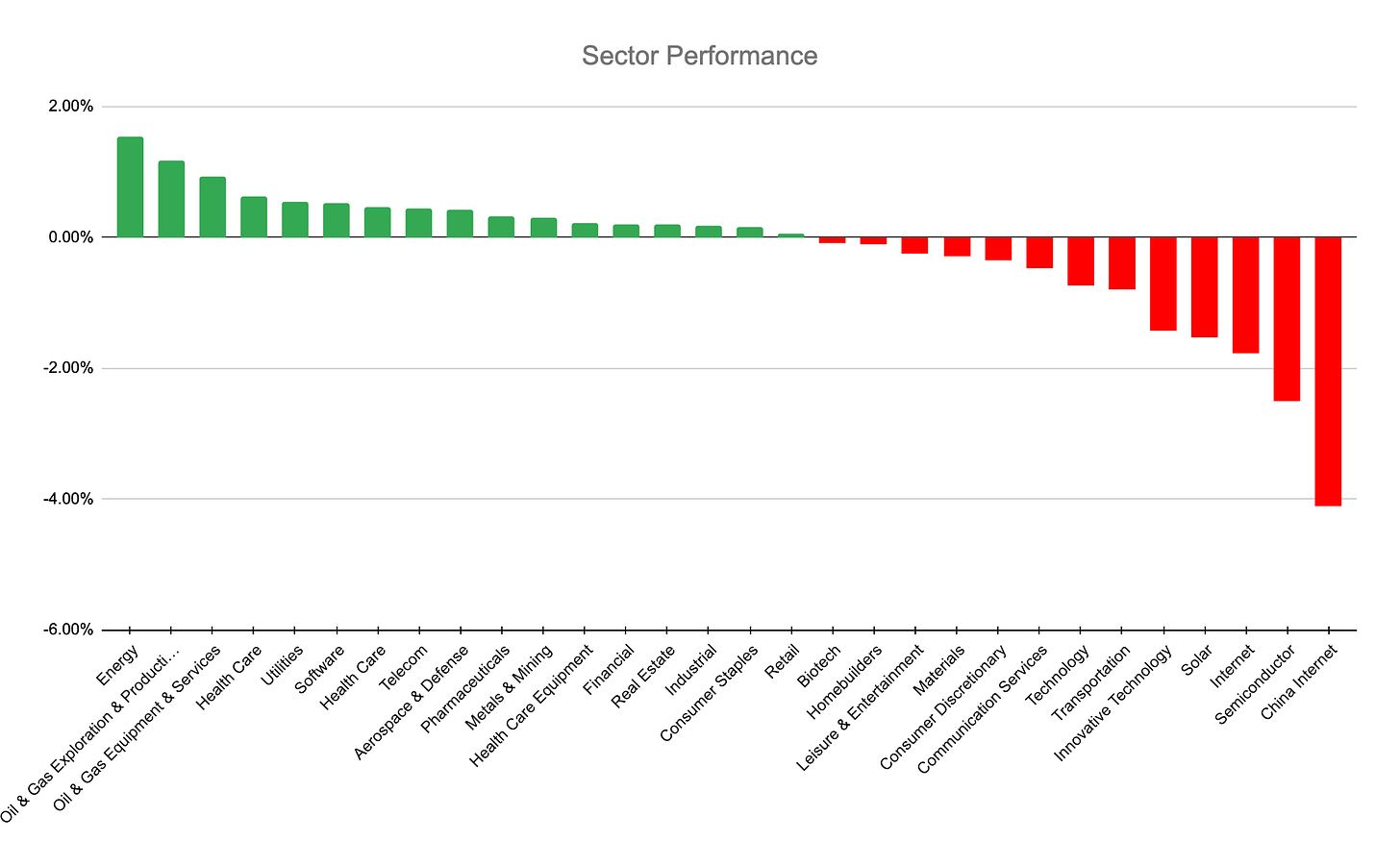

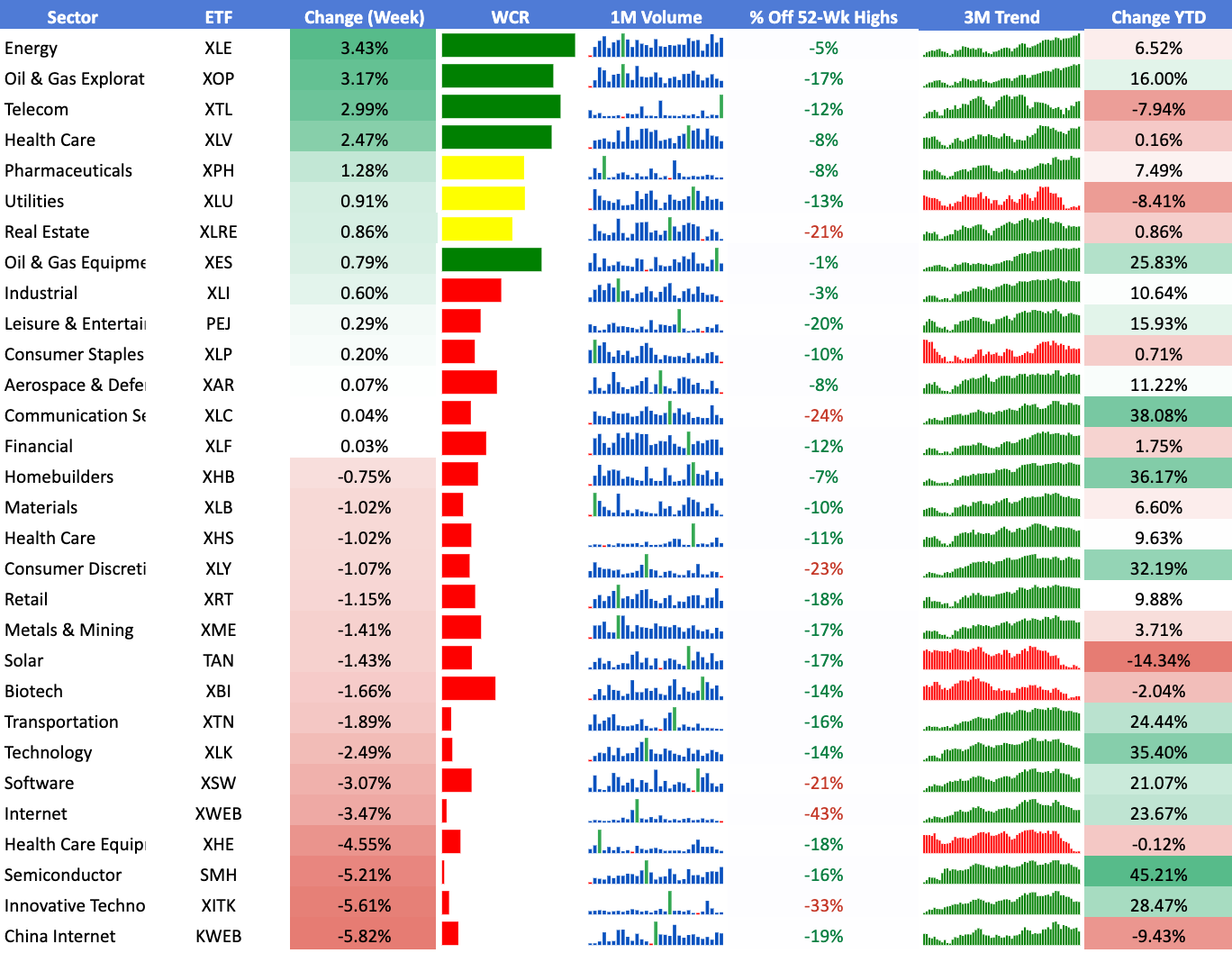

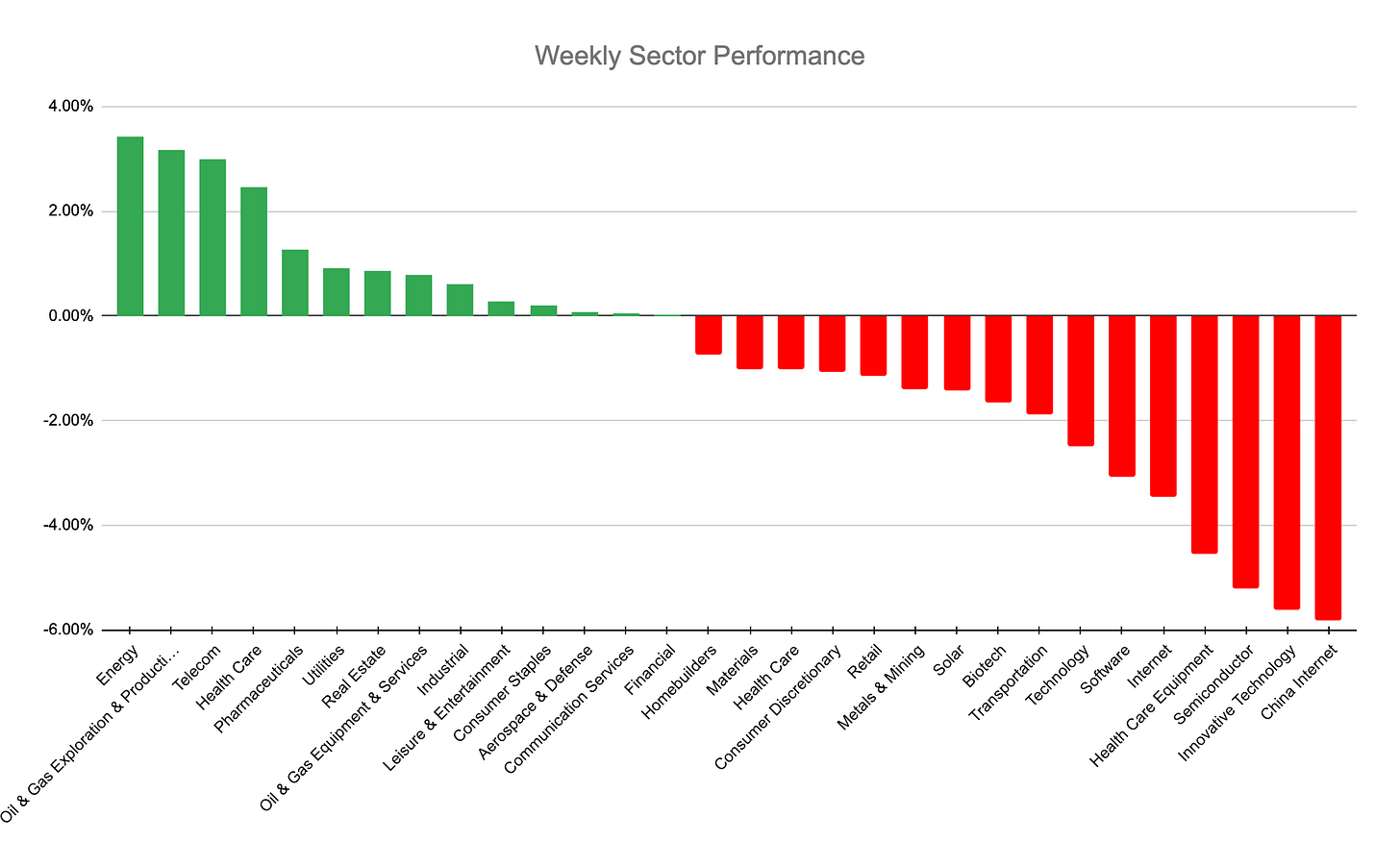

Individual Sector Analysis

Average: -0.20%

I am linking the sectors watchlist in tradingview for your convenience, here

XES 0.00%↑ Continues building on its recent momentum here with a nice shakeout just a few sessions ago to undercut the 10/20MA but close well on the session and back above both - inside day last session as this continues riding the 10MA higher:

XLV 0.00%↑ Like how this is shaping up here above KMAs and a few more days of tightness could have this setup well:

XLF 0.00%↑ Financials flagging out quite nicely here:

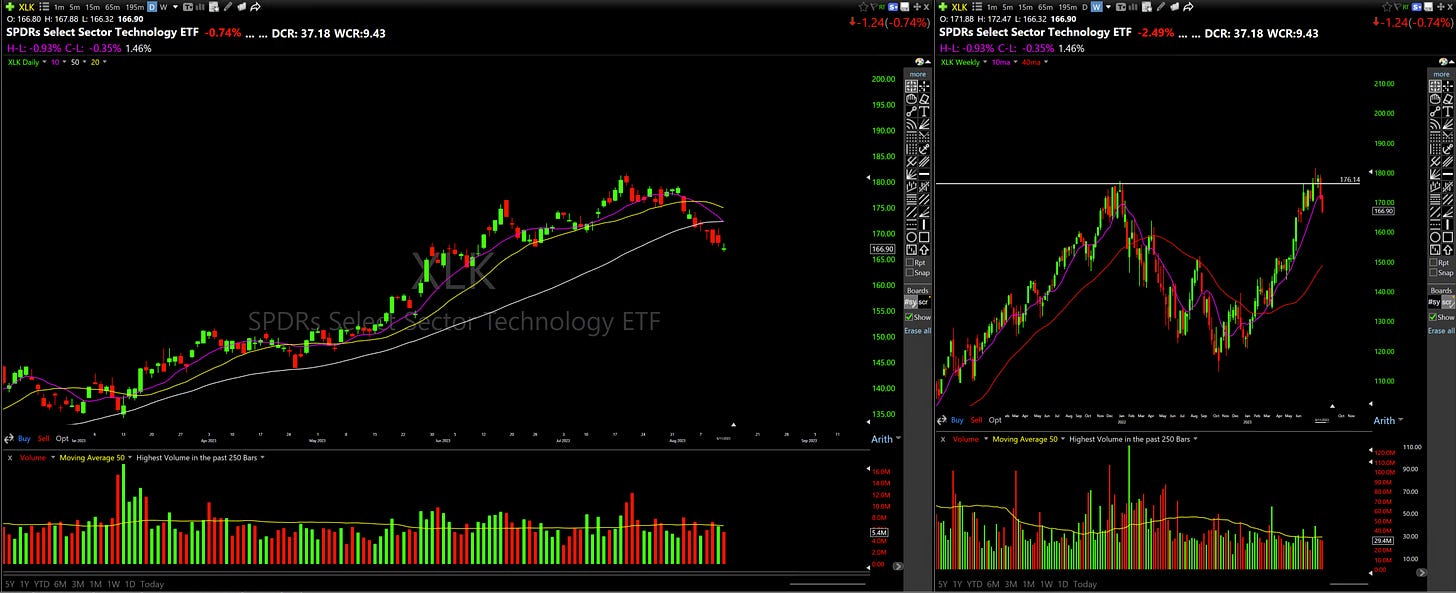

XLK 0.00%↑ Tells you all you need to know about the recent weakness in growth - failed breakout in tech above this 176 area on the weekly and sellers have been in control since:

Average: -0.82%

Upcoming Earnings

Scans

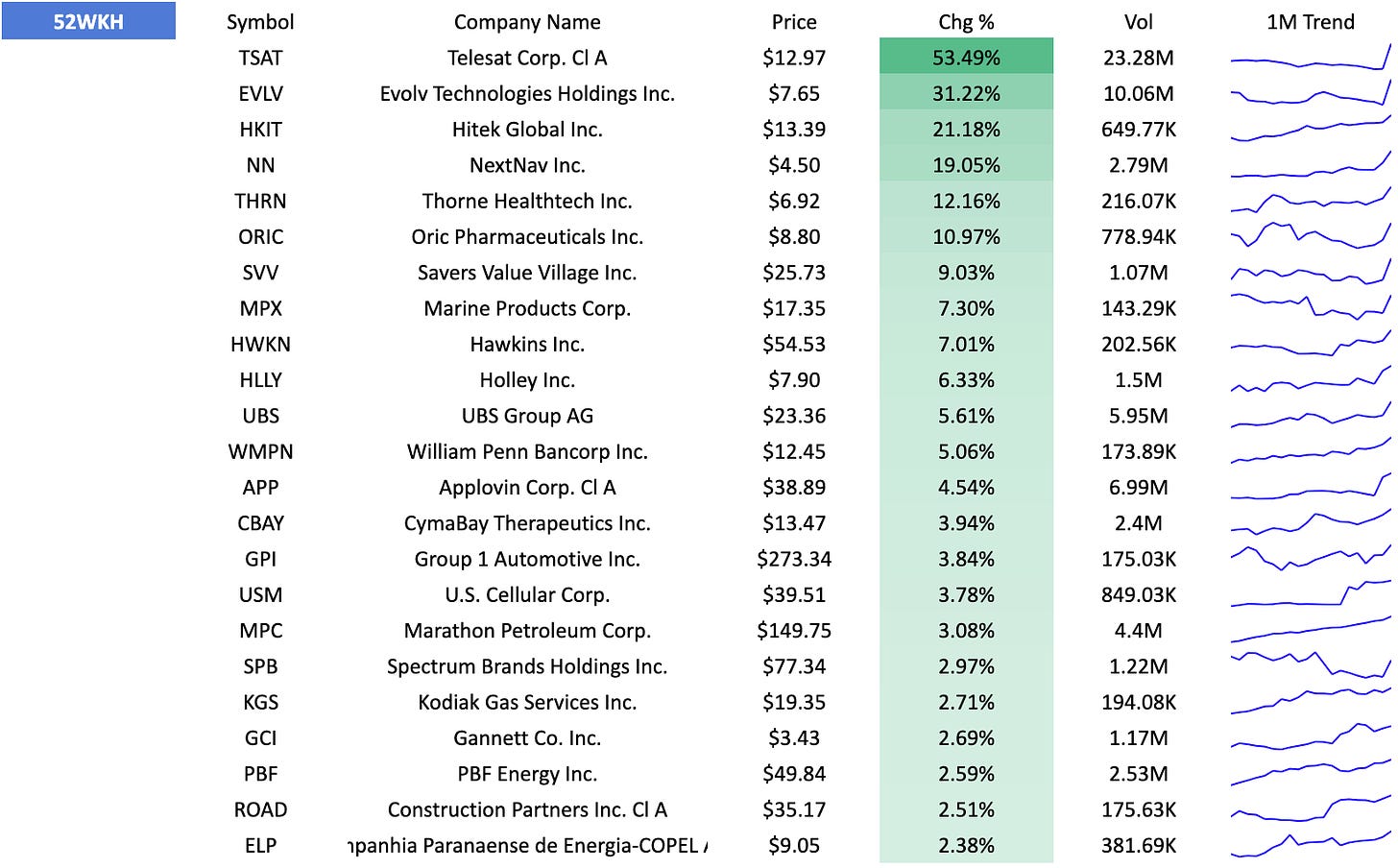

52 Week highs

9 Million breakout

+10% Breakout

Pocket Pivot

Personal Portfolio Update

I remain patiently in cash waiting for sound setups to emerge.

Focus List

Reminder to NOT force anything and rather wait for your edge to show up clearly!

Pivots

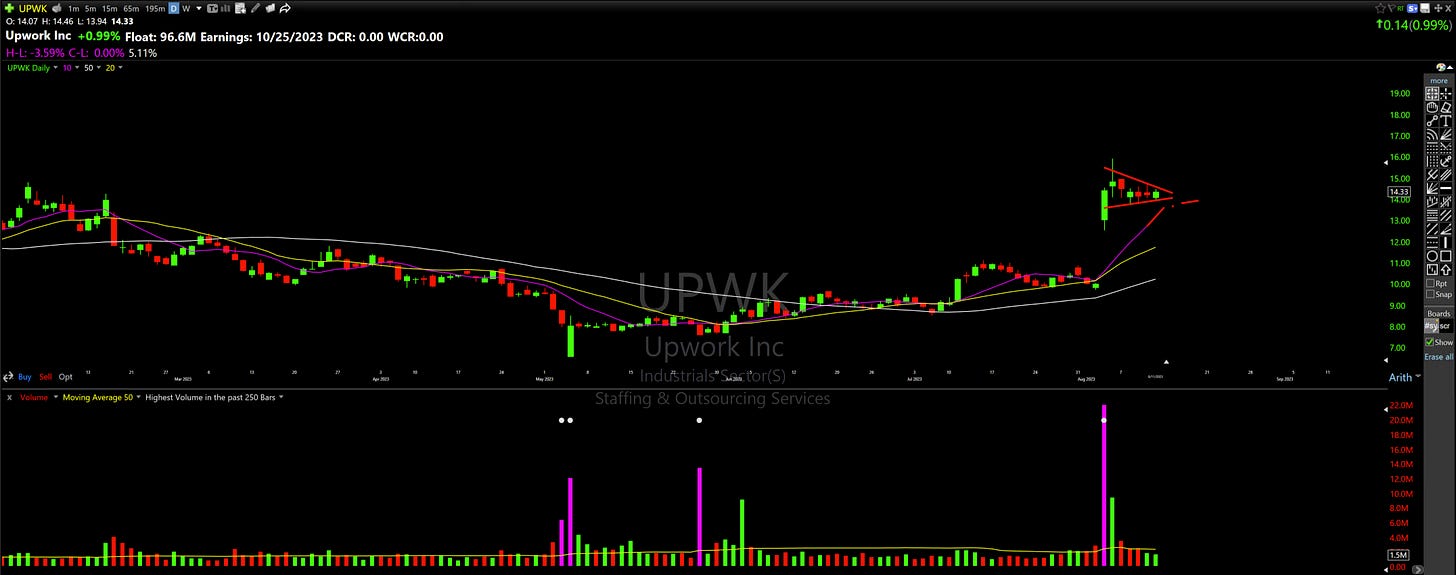

UPWK 0.00%↑ Ideally tightens up a few more days to all the 10-day to catch up to price: