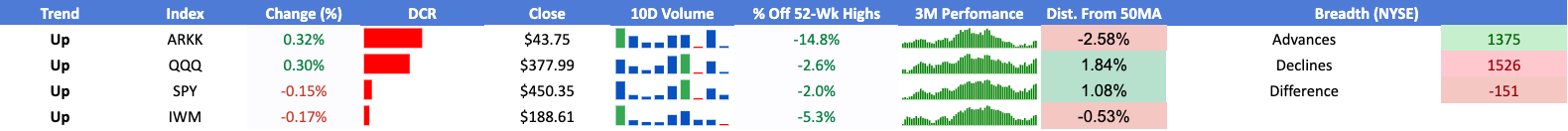

General Market Overview

Seeing some improvements in the overall environment as that QQQ 0.00%↑ is now back above the 10/20 EMAs which are stacked in the right order.

Good to keep in mind that we are now up 5 sessions in a row heading into the last trading session of the week - should keep this in mind if thinking about starting any new positions / taking on additional risk heading into the weekend:

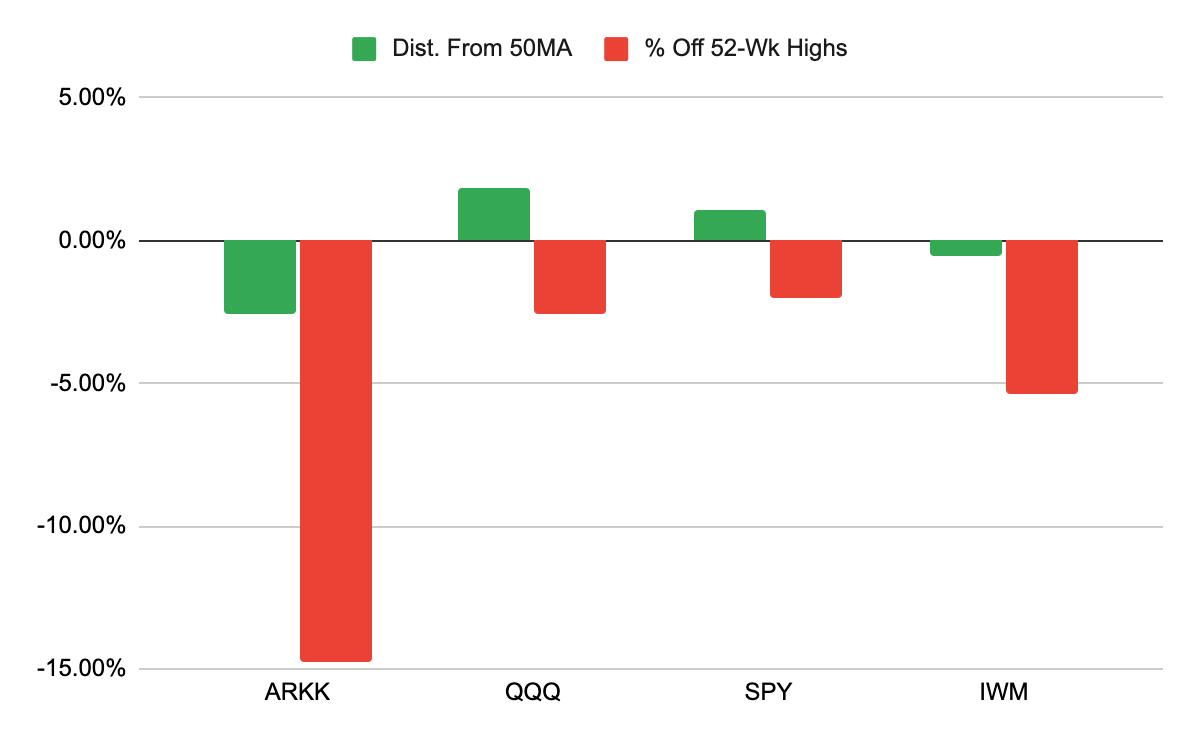

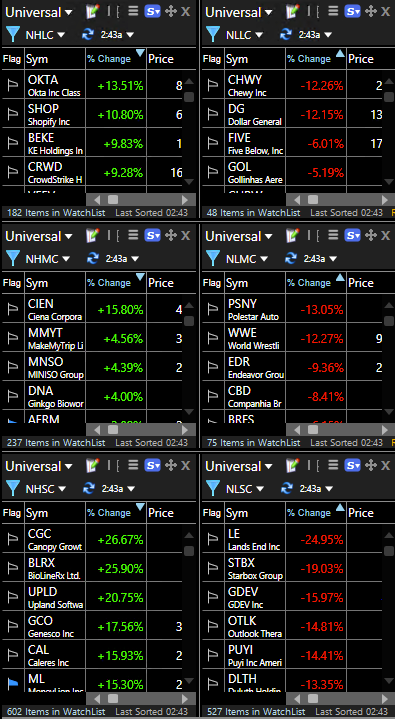

Breadth summary - New highs / New lows:

Large caps: +182 / -48

Mid caps: +237 / -75

Small caps: +602 / -527

Market signal out of a downtrend and now close to firing green as new highs outpace new lows for 3 days in a row:

Check out my website here for a FREE gift - stockbsessed.com

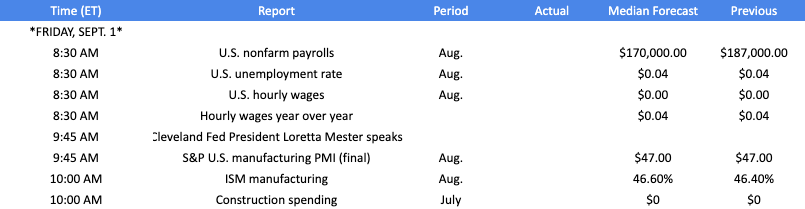

Some important and potentially market-moving events to keep an eye on into tomorrow:

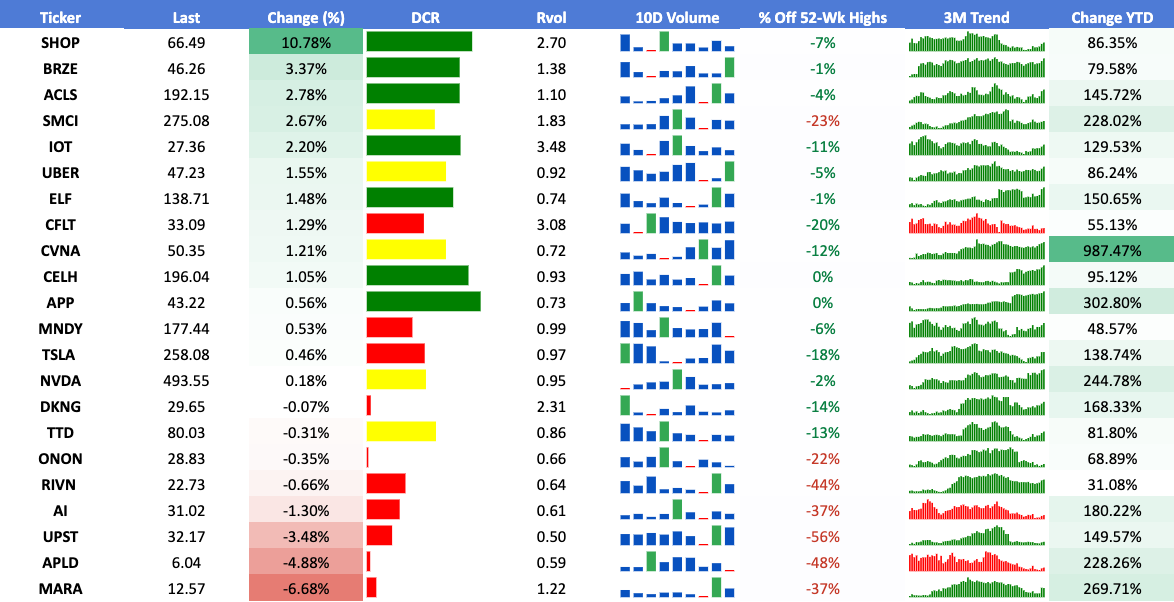

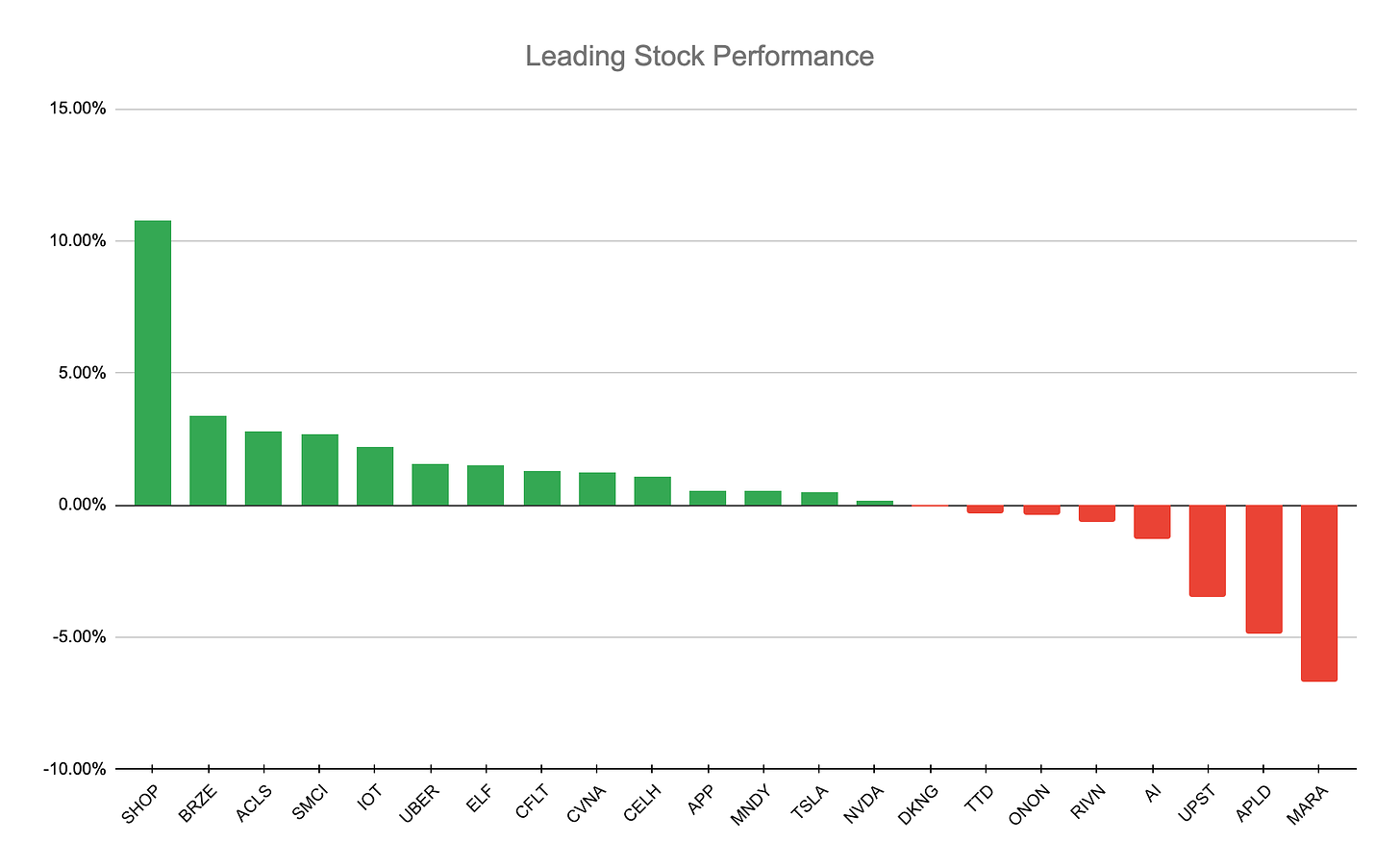

Leading Stocks Analysis

I am linking the leaders watchlist in tradingview for your convenience, here

SHOP 0.00%↑ “Rallied +10.80% after Amazon announced that an app integration will allow Shopify stores to offer Buy with Prime.”

Strong response on the session to some news with a strong gap and close above all key moving averages - like the clear accumulation seen through the pickup in volume today and watching for this to tighten up over the next few sessions as we approach prior highs:

BRZE 0.00%↑ Up 5 sessions in a row as it finally clears this area of resistance around the 45 spot that has been keeping it down since early June. Focus here is on the weekly as this young IPO is clearing some key areas of resistance:

IOT 0.00%↑ Strong action here as it keeps clearing important areas of resistance - most recently the 26 spot to reclaim the 50-day MA on Wednesday. Also notice the quick undercut and rally of the prior earning’s gap-up which added fuel to this latest +25% upside move since:

UBER 0.00%↑ Key moving averages got nice and tight along with price and now pushed up from that area to make its way back up to prior resistance around the 47.50 area - up 4 sessions in a row and watching for some tightness:

CVNA 0.00%↑ Broke out of this setup we highlighted over last weekend and ran +20% from there after finding buyers at the 50-day and tightening up nicely as we now consolidate this move with KMAs rising:

CELH 0.00%↑ Continues acting well since the most recent earnings-related gap-up as it keeps trending upwards since clearing the 183 pivot:

APP 0.00%↑ Similar structure to CELH 0.00%↑ - keeps trending upwards nicely with higher highs and higher lows. Clear stair stepping pattern here as buyer keeps pushing key areas after quick pauses:

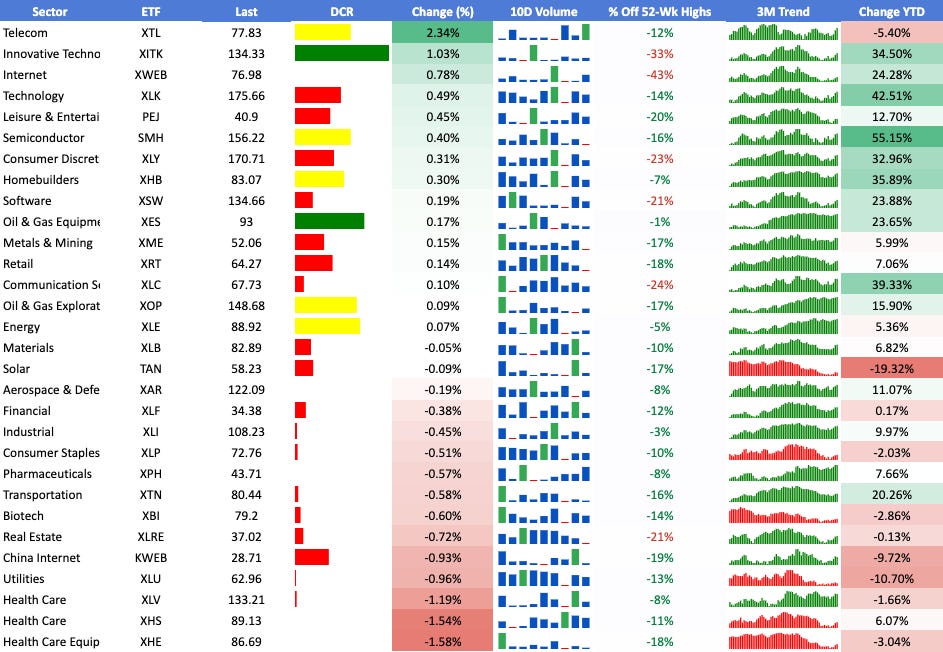

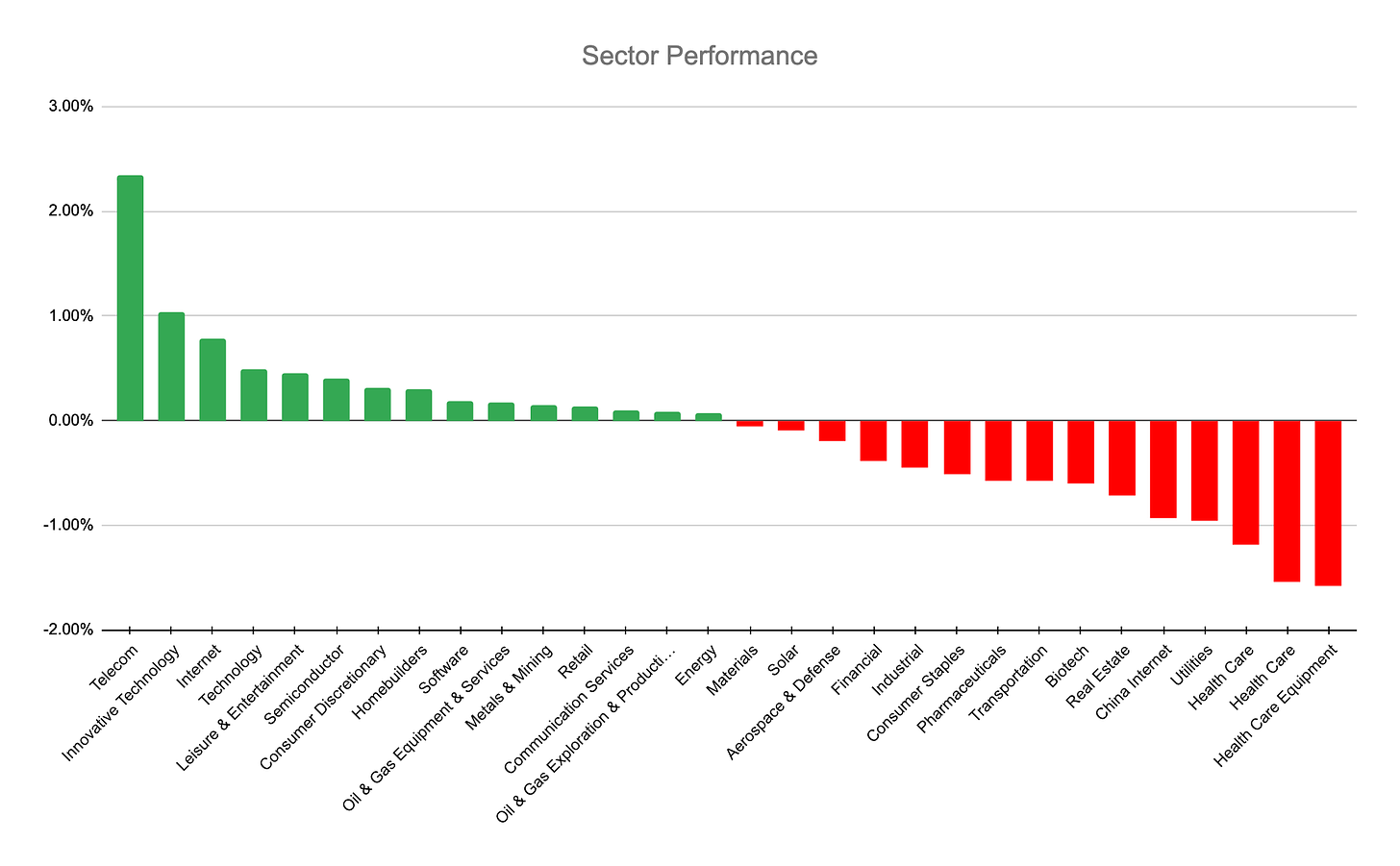

Individual Sector Analysis

I am linking the sectors watchlist in tradingview for your convenience, here

XES 0.00%↑ XOP 0.00%↑ Oil and energy remain very strong here with lots of these names showing up in my scans - usually not the best sign for the rest of the market when such groups are looking this good but yet to be see how the coming pullback will be handled:

XLK 0.00%↑ Acting well since pushing above 170 area and then the reversal day’s high to reclaim the 50-day. Encouraging to see tech back above all KMA’s:

KWEB 0.00%↑ Think its important to keep an eye on China names here which have shown some clear strength recently - like how this is now pulling back to the KMAs which are bunched up:

MJ 0.00%↑ Cannabis stocks with a BIG move here:

Scans

52 Week highs

9 Million breakout

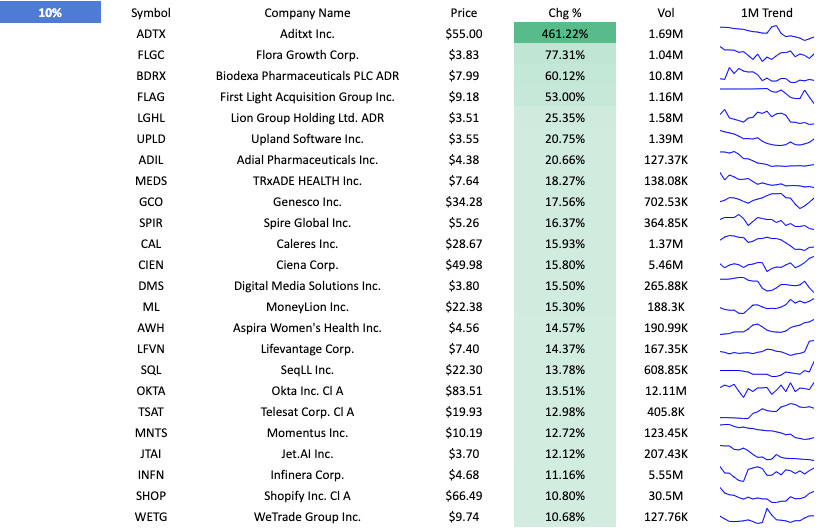

+10% Breakout

Personal Portfolio Update

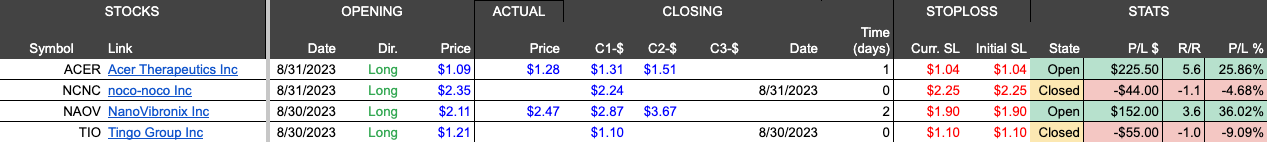

Made 4 trades this week - all using opening range breaks. I am currently working very hard on writing several articles on this setup and can’t wait to get them out to you guys.

2 last session:

NAOV 0.00%↑ - still holding half:

TIO 0.00%↑ Got stopped out before this made a big move and didn’t re-enter:

2 today:

NCNC 0.00%↑ - stopped out quickly:

ACER 0.00%↑ - still holding remaining: