Today we have Scott St. Clair from Investors business daily joining us to give some insight into his 20+ year long journey in the markets. Very appreciative of him coming on and taking the time to share some important lessons and learning experiences that traders go through throughout their careers, hope you guys find this helpful!

Be sure to check out his twitter for some great insight!

Background

After graduating from college, I wanted to go to Law School and become a sports agent. I did not get into any of the schools of my choice so I figured I would get a job and try a few years later.

I had a course in Investments in college and my professor was a former stockbroker, I really enjoyed this class so I thought I would try to be a stockbroker as well. I had no idea what a stockbroker really did; but I was able to get a position at a firm in Irvine, CA. If you have seen the movie Boiler Room, I worked there! We smiled and dialed all day, everyday.

In the movie, they sold stock in fake companies. We covered “real” companies, but of little quality. They were mostly “penny stocks” and the objective was to sell.

There was no system for making money or managing risk. They had a saying; “the best time to buy a stock is when the market is open”. After 4 months, I was totally disillusioned and ready to quit. A friend of mine knew I was going to quit and he referred me to a broker at another firm. He recruited me to come work for him and learn the right way to do business.

This broker followed technicals and fundamentals and risk management and it was a tremendous learning environment. In March 1995, I got my first significant check ( to me anyways as I was struggling to build my book) and I deposited $3,500 into a brokerage account to start trading for myself.

At the time, the books that heavily influenced me were:

How to Make Money in Stocks, O’Neil

Reminiscences of a Stock Operator, Lefevere

Market Wizards and New Market Wizards, Schwager

Secrets for Profiting in Bull and Bear Markets, Weinstein

Routines

I am a big proponent of a strong weekend routine. I find all of my ideas with a thorough weekend routine.

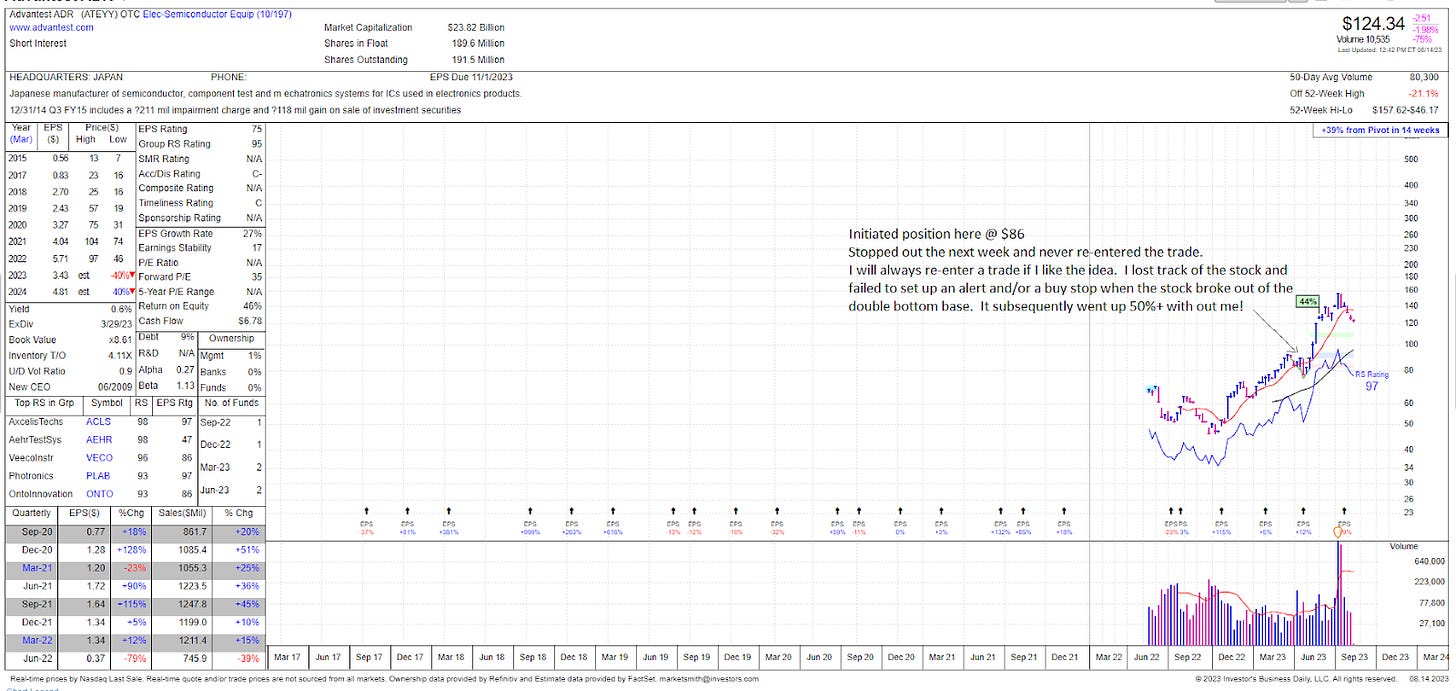

I use MarketSmith almost exclusively to find and manage ideas. I scan through a ton of charts looking for stocks with strong fundamentals, technicals, price action, or ideally all of the above. I will then set alerts on these names so that if they trigger during the week, I will get into motion and initiate the trades. I prefer, if possible, a trendline alert so I can capture the name as soon as it starts to turn up.

Sometimes, on Sunday night, I will enter buy stops on my favorite names so that if I get busy during the trading day, I will get executed automatically. This takes me anywhere from 1-4 hours typically. A lot depends on the health of the market. In a good market, there are obviously many more potential setups.

During the week, I will manage my current positions and adjust stops/alerts accordingly. Sometimes I will stumble upon a new name if a stock breaks out of a base or gaps up on an earnings announcement. MarketSmith provides automatic event alerts for these setups so sometimes I can find a name I might have missed in my weekend routine.

What Gets Me Interested In a Stock

I am watching Nvidia ($NVDA) currently, as it has finally pulled back. If the stock can find any type of strength near this 50-day moving average pullback I will re-initiate a position. This has been one of the leaders in the market rally. Typically these big leaders will find support in this area. If NVDA cannot bounce, it could be a tell for the changing market environment and you would look for new leadership or possibly a market correction is in order.

Today, August 14, it has finally shown some life. I tried the past 2 trading days and got stopped fairly quickly but today’s entry on the open ($405) is working so far.

Another completely different name would be Valaris ($VAL). This is an oil/gas offshore contract equipment provider. VAL is setting up in a very large base so could potentially breakout. For a trade like this, I almost always start with a standard 5% stop loss on a 10% portfolio position size. This way if I am wrong, my total risk is 0.5% of my total portfolio. If the trade were to move in my favor, I would gradually move up my stop. At some point, I would peel off some of the position as I like to sell into strength for the majority of stocks I trade.

Risk Management & Position Sizing

I use a simple system of 10 stocks max, 10% position sizes. It would be extremely rare for me to have 10 stocks at 10% position size but that is the starting math. This makes trading decisions fairly simple. If I get a trade signal, I just take a calculator and calculate 10% of the portfolio size and that is the trade. I do this for ALL my cash accounts. Roth IRA’s, IRA’s, Coverdell, 401-K…. I will typically trade my margin accounts more aggressively in size and activity.

If I am not trading that well, I will reduce the 10% starting position to 5%. I can go above 10% in size. If the stock is working, the combination of price appreciation and small add-ons can increase my position to as much as 25% (this is rare though).

It’s only in really strong markets that you will want to have this type of individual stock exposure. If you want to achieve big percentage gains, you are going to have to be concentrated in great names. From a risk standpoint, you must trust your process and trust your ability to cut and run quick if things change.

Practicing Progressive Exposure

If I was 100% cash in a market, I would start with a 10% position in one name. If it started to work, and/or there was another name I liked, I would take a 10% position in that name to get me to 20% invested. At some point, let's say 30-50% invested, I would need to see some progress before continuing. If I am making some progress, I will just rinse and repeat this process.

For individual stock trades, I will add in small increments to stocks that are working. So if I have 1,000 share of XYZ @ $100, I might add 200 shares @ $101, 300 shares @ $103, 100 shares @ $105.

I wish I had a more methodical way of adding but the above scenario is typical of how it seems to play out. I just want to get more money into the stocks that are working but avoid driving my average price up too quickly.

Managing Positions

A sell signal would occur if a stock hits my stop. My stops are adjusted as stocks ebb and flow but the original stop is almost always a standard 5% loss from my entry price.

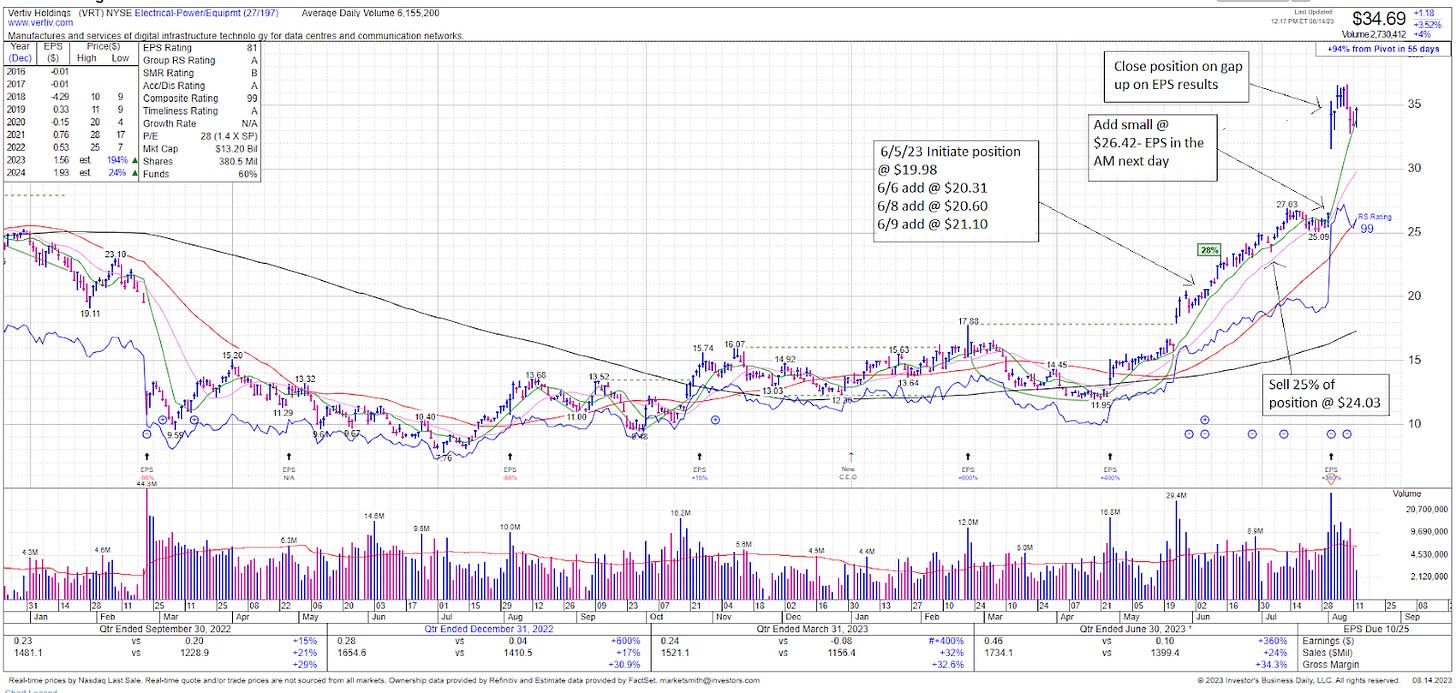

Selling into strength is a bit of an art versus a science. I will typically sell into strong gaps in the morning or if a stock has been moving for weeks and then gaps up on earnings, I will typically sell most, if not all of that position into that strength (VRT for example on 8/2/23).

Selling strength is difficult, as almost always they will continue to go up. “Why should the stock stop going up just because you sold it?”

But after reviewing thousands of trades I have done in my career, most of the time I am getting out while the getting is good. Unfortunately, this will mean that I will have sold Apple (AAPL) and Google (GOOG) many multiples ago. But I also don't own any of the laggards like Intel (INTC) which I sold in the $50’s in late 1999 and have never revisited since (currently $34). We all remember the ones that got away of course. But there is a huge opportunity cost of sitting in laggards for years and years.

Regaining Focus

The correct answer would be to step away, but I love to trade! So I will reduce my size (like take my initial position size from 10% to 5%).

In my margin accounts, I might transfer money out of the account to my bank. This forces me to trade smaller and will protect myself from myself. I will keep doing this until the bleeding stops. After a few weeks or months, once I feel like I am back in sync with the market, I can always send the money back. I cannot do this in retirement accounts so I have to trust the discipline process I have been using for years. I can recall a Marty Schwartz story that reflects perfectly on this. He was having a really bad day in the markets. His wife, who he worked with just kept saying to him all day long “Get smaller. Get smaller.” This is extremely sound advice when you are in a slump.

How To Maintain Discipline

A couple of ways. I try to distract myself with other things when the market is open.

If you are just sitting there, staring at it all day, you will overtrade. It’s like sitting at a slot machine all day. The most important times of the day are the open and the close. Everything else is mostly noise.

So I try not to execute any trades between the hours of 8AM PST and 11 AM PST. When I traded for a living, I would often have a movie on in the background as a distraction from the screen. I have watched some movies dozens and dozens of times!

Learning From Losses

My first losing year was in 2002. I had made money in the great bull market from 1995-2000 and also in the bear market of 2000. By 2002 I was trading so big and I felt like I “knew” better than the market.

I got chopped to death in 2002. I got into a small hole and kept digging. I kept trying to “make the money back”. It was a real ego check. Eventually I realized what I was doing so I really reduced my size and tried to get in sync with the market again before I put on any size. I was making my living from the markets so it was a very humbling drawdown.

In 2007, the brokerage firm I was with went out of business. I decided it might be a sign and so a friend of mine and I set up our own capital company and started a hedge fund in 2008. After a couple of flat performance years it was hard to see the forest through the trees as we were in the teeth of a really nasty bear market, thus we closed the fund.

In 2010, I went to a seminar with Bill O’Neil as listening to him was always inspiring. This led me to decide I wanted to work for William O’Neil + Co. I knew that Bill O’Neil did not miss the rally and he owned a lot of the great names from that period. In 2010, I was offered a job at MarketSmith (at the time a subsidiary of William O’Neil + Co.) and I took it. Being a part of that organization was a fantastic learning experience as you are surrounded by like-minded market operators.

Post-Trade Analysis

I have done a much better job of keeping good records since 2010. I wanted to be a Portfolio Mgr. for William O’Neil + Co. once I joined the firm so I knew I had to keep really good records of my trades and performance. I use Excel to track and record my equity curve. I also use a software program called Tradelog which allows me to search all of my trades each year. At William O’Neil + Co. a post-analysis of your yearly results is an important part of their process. I will pull charts of my best and worst trades and try to determine my strengths and weaknesses. Do I sell winners too soon? Do I take losses to slow? Did I make significant money in my best ideas? These are areas you want to think about when doing your post-analysis.

Ranking Stocks

There are certain factors I will use like RS Rating, EPS Rating, earnings last few quarters, liquidity and sponsorship. There is an art to this for sure.

Do any of my favorite funds have a position? Have they increased or decreased the position size in last few quarters? Fidelity fund, Baillie Gifford, Lord Abbett, Baron Funds are a few of my favorite families to follow.

Most Common Trading Errors

Position sizing and taking losses. Most beginning traders probably size too big and thus when they encounter a losing trade they will freeze as the amount of the loss is “too big” to take. Everyone wants to make money. No one gets into trading to lose. You’ve got to love your losers.

Top 5 Trading Rules

I’m going to steal the rules from Ed Seykota in Market Wizards. I have never seen a more succinct list:

Cut losses

Ride winners

Keep bets small

Follow the rules without question

Know when to break the rules