INTERVIEW: Studying Historical Winners To Find Future Ones

With @traderCharlieM

It is useless to pursue a career in trading and aim to use the market as a tool to improve your quality of life if you are not ready to put in the work.

Simply put, you cannot expect to become a great trader and achieve super-performance just by watching stocks in real time - you must first understand what constitutes a good setup by studying previous winners, only then can you begin to learn what to look out for.

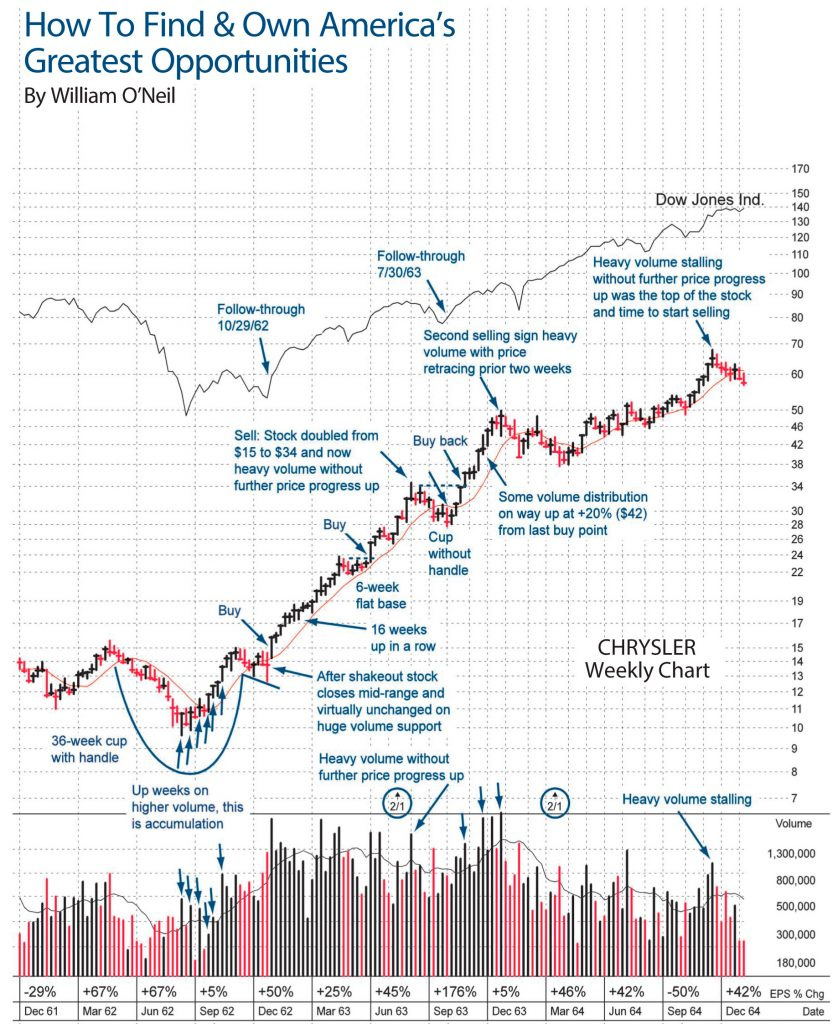

While there are several resources available, such as William O’Neil’s mark-ups of America’s greatest winners (as seen above)- there is no resource more valuable than manually going through and studying historical setups for yourself.

Jack Schwager emphasized this by saying:

“The hard work in trading comes in the preparation. The actual process of trading, however, should be effortless.”

Today we have @traderCharlieM, who frequently posts several past momentum leaders on twitter, joining us to walk us through the process of finding and studying previous winners.

How did you originally get into trading and what led you to studying past winners so thoroughly?

I started trading in March 2020 during the Covid crash, when my dad introduced me to trading and the stock market. I attempted to learn to trade on the internet, which led me to futures trading, then day trading with options, and then fundamental investing.

During my time investing, I started learning about many legendary traders such as Mark Minervini, David Ryan, and many more putting up massive returns, and they were swing/position trading. Eventually, the losses from investing became so drastic that I threw in the towel, cut my losses, and committed to studying and learning from these market wizards so I could put up the same returns. Through studying the most legendary traders who consistently put up jaw-dropping triple-digit returns, I noticed the one factor that separated the legendary performers from great performers is that they studied how stocks move.

What does the process of finding and studying past setups look like?

There are many ways to go about studying past setups, but for me, it was to learn how the biggest winning stocks TRULY moved, so I could take advantage of them. BEFORE you build a database, it’s important to know some basic setups so you know what you’re looking for. Taking what I learned from legendary traders like Mark Minervini, William O’Neil, and Qullamaggie1 that showed their findings from studying the biggest winning stocks, I looked for those same setups they taught.

The process was simply going through every stock that was listed on the NASDAQ, opening the stock’s chart and looking for big moves. This is exactly what Qullamaggie said to do (instead of the NASDAQ, he said all US Stocks). Stocks up 200% in 3 months, 500% in 6 months, 1000% in 1 year, the stronger the stock performed, the better.

Then, you look for setups during the stock’s advance and you log each setup you find! If you want to catch the biggest winning stocks of the future, look to the past! The same patterns repeat themselves over and over and over again, and after building your own database of the biggest winning stocks, you will notice this as well.

Qullamaggie on building a database and studying the biggest winning stocks:

“You only need to do it once…and you probably won’t have to work another day in your life.”— Qullamaggie

Many of the setups you post seem to be variations of VCPs, which traders and resources would you say have been influential to your style of trading?

Mark Minervini and Qullamaggie are my biggest influences in my trading. Mark’s books and interviews taught me the fundamental principles of successful trading, and I would recommend ALL traders who are serious about attaining super-performance read all 3 of his books. It is absolutely true that most of the setups I post are variations of VCPs, because that is the most common setup I found in the biggest winning stocks and a timeless concept built on the principles of supply and demand.

From there, I learned about Qullamaggie, who turned $5000 into over $100,000,000 in less than 10 years. He taught me the importance of studying the biggest winning stocks YOURSELF. Only a fraction of stock traders have made the effort to carefully study the characteristics, behavior, and patterns of super-performance stocks, and the most successful traders have studied the biggest winning stocks inside and out.

Since I’ve applied what I learned from Qullamaggie and studied the biggest winning stocks myself, I’ve stopped believing the dogma spread by traders about why you shouldn’t trade stocks for reasons like it being too low of a price, or that it has no fundamentals. I have countless examples of stocks that are low priced and have the absolute worst fundamentals that in a short period of time go up 30-100% or even more despite their ‘weak fundamentals’.

What are some common characteristics you have identified among these big winning stocks?

It all depends on how you define a big winning stock. The amount of time it takes for a stock to make a big move is just as important as how big the move is. Given the choice, I will always pick the stock that makes a 30-50% move in 1-3 weeks than a stock that makes a 100-200% move in 1 year. This is because not only are there many more stocks that make 30-50% moves in 1-3 weeks, but also by catching just a few 30-50% moves, it will be equivalent to gains made by one 100-200% move, but you will have been able to get that return much more quickly.

The common characteristics I’ve noticed are built around this philosophy of getting big gains as fast as possible without losing opportunity cost.

The most common characteristic is the ADR (Average Daily Range) of the stocks almost always being above 5. That means that on a daily basis, the biggest winning stocks on any given day have intraday fluctuations of 5% or greater. Secondly, the biggest winning stocks almost always had momentum of +100% or greater in less than 2 months BEFORE setting up to make a second buyable move. Lastly, after meeting the first 2 criteria, when the biggest winning stocks almost ALWAYS display VCP characteristics in their setups before breaking out.

How has studying previous moves allowed you to identify areas of weakness in your system over time?

Studying previous winners has been one of the best, if not the best decision I have made in my trading career. Studying previous movers taught me what price fluctuations are normal and abnormal, which means I knew what to expect from any trade I enter. So comparing what I’ve learned from previous setups I’ve taken, I could notice what I was doing correctly and incorrectly.

For example, after building my database, I learned what sell rules worked best to capture the largest move I could, and for me, that would be selling a portion into strength around 10-25% after 3-5 days and trailing the rest on the 10EMA. But looking back at past trades, I was often selling all of my position on days 3-5, and the stock would keep going as I would have no position! From studying the previous winners myself, I knew that what I was doing, in the long run, would cost me a lot, so I stopped!

Another example would be pinpointing my entry points to very, very specific areas from studying the biggest winners. Looking back at the trades I did before building my database, they looked nothing like the setups that were in my database of winning stocks. After having that realization, I started only looking for setups that were similar to the ones in my database, and as a result, my trading results improved dramatically.

When you’ve spent a thousand hours studying a single setup, you learn almost exactly what to do in any situation, so it is hard to make meaningful mistakes because you know what to expect in almost any situation.

What are some specific changes (such as to your set of rules) you remember making that have helped you improve your performance?

The biggest change that helped me to improve my performance was to actually have a set of rules. Vowing to never average down and always trade with a stop loss were 2 of the most important rules I put in place a long time ago. Other than that, what helped me the most was the changes in my mindset and belief system, some of which are:

Forgetting about the money, and instead focusing on being the best trader I can be and making the highest quality decisions.

Embracing the pressure of trading. Pressure is the hallmark of champions and the gateway to opportunity!

Focusing on setups and forgetting about the indexes. The indexes are secondary, what is most important is the feedback your trades are giving you!

How do you scan for these setups in real time and what is your criteria for a good setup?

I use Qullamaggie’s 1, 3, and 6-month scans that he shares on his youtube channel, you can find them here:

My general criteria on what makes a good setup is this:

A double off the recent lows. More momentum the better.

Price consolidates for 2 weeks to 2 months with volatility contraction from left to right

Multiple tight days on the 10 and/or 20 moving averages

Here are some examples of 5-star setups to train your eye:

OSIP on 2/1/2000

NEPH 8/7/2009

PRTS 7/8/2000

MFW 3/21/2007

NVAX 6/15/2020

IZEA 1/5/2021

GRA 8/26/2004

What position size do you typically allocate to such trades and how important is progressive exposure to you?

Generally speaking, during favorable trading environments, I typically allocate 10-20% to each trade, depending on how good the setup is, risking 0.5-1% of my account per trade. Progressive exposure is absolutely critical and is how I protected my account during the 2022 bear market. During poor trading environments, I decrease my position size per trade to 5% and less.

When in such a trade, what is the criteria that would make you close out the position?

I always look to sell 1/4 to 1/2 of my position up around 10-30% (preferably 20%+) into strength within the first 2 weeks of purchase.

I learned this from Qullamaggie and his general 3-5 day sell rule. After taking some profits to finance the initial risk from the trade, I trail the rest of my position with the 10 and 20 exponential period moving averages (EMAs), along with selling more into extreme strength.

My rule is that if a stock I own closes below the 10 EMA, I have to cut it down to a 25% position or less, and if it closes below the 21 EMA, I must close the position. I am almost always out on a close below the 10 EMA. As I trail my position on the moving averages, I move my stop to breakeven and move my stop higher to significant support levels as the stock advances. I ask myself, “if this stock breaks this level, do I still want to own this name?”. If the answer is no, then I move my stop there.

How do you determine the kind of market environment and know when to be aggressive vs when to take a step back?

I determine the health of the market through the feedback from my most recent trades.

If they are showing me decent profits of 10-20%+, then I will be more aggressive as I have open profits to use to finance more risk. On the other hand, if my last 3-5 trades have all stopped me out, I will decrease my position size on my next trades and be less aggressive.

Relevant links:

Qullamaggie:

Mark Minervini

William O’Neil:

David Ryan:

Some necessary advice from Qullamaggie:

How to get started:

Below find a link to Charlie’s Chart Book Database which he has kindly shared for free:

Huge thanks to

for sharing his thoughts and walking us through what it takes to develop a well-structured and profitable momentum trading system.

Great article.